Intermediate Financial Management, 14th Edition by Brigham Test Bank

Document Content and Description Below

Test Bank for Intermediate Financial Management, 14th Edition, 14e by Eugene F. Brigham, Phillip R. Daves TEST BANK ISBN-13: 9780357516775 FULL CHAPTERS INCLUDED Chapter 1: An Overview of Finan... cial Management and the Financial Environment 1.1: Introduction 1.2: How to Use This Text 1.3: The Corporate Life Cycle 1.4: Governing a Corporation 1.5: An Overview of Financial Markets 1.6: Claims on Future Cash Flows: Types of Financial Securities 1.7: Claims on Future Cash Flows: The Required Rate of Return (the Cost of Money) 1.8: The Functions of Financial Institutions 1.9: Financial Markets 1.10: Overview of the U.S. Stock Markets 1.11: Trading in the Modern Stock Markets 1.12: Finance and the Great Recession of 2007 1.13: The Big Picture 1.14: e-Resources Chapter 2: Risk and Return: Part I 2.1: Investment Returns and Risk 2.2: Measuring Risk for Discrete Distributions 2.3: Risk in a Continuous Distribution 2.4: Using Historical Data to Estimate Risk 2.5: Risk in a Portfolio Context 2.6: The Relevant Risk of a Stock: The Capital Asset Pricing Model (CAPM) 2.7: The Relationship between Risk and Return in the Capital Asset Pricing Model 2.8: The Efficient Markets Hypothesis 2.9: The Fama-French Three-Factor Model 2.10: Behavioral Finance 2.11: The CAPM and Market Efficiency: Implications for Corporate Managers and Investors Chapter 3: Risk and Return: Part II 3.1: Efficient Portfolios 3.2: Choosing the Optimal Portfolio 3.3: The Basic Assumptions of the Capital Asset Pricing Model 3.4: The Capital Market Line and the Security Market Line 3.5: Calculating Beta Coefficients 3.6: Empirical Tests of the CAPM 3.7: Arbitrage Pricing Theory Chapter 4: Bond Valuation 4.1: Who Issues Bonds? 4.2: Key Characteristics of Bonds 4.3: Bond Valuation 4.4: Changes in Bond Values over Time 4.5: Bonds with Semiannual Coupons 4.6: Bond Yields 4.7: The Pre-Tax Cost of Debt: Determinants of Market Interest Rates 4.8: The Risk-Free Interest Rate: Nominal (r) and Real (r*) 4.9: The Inflation Premium (IP) 4.10: The Maturity Risk Premium (MRP) 4.11: The Default Risk Premium (DRP) 4.12: The Liquidity Premium (LP) 4.13: The Term Structure of Interest Rates 4.14: Financing with Junk Bonds 4.15: Bankruptcy and Reorganization Chapter 5: Financial Options 5.1: Overview of Financial Options 5.2: The Single-Period Binomial Option Pricing Approach 5.3: The Single-Period Binomial Option Pricing Formula 5.4: The Multi-Period Binomial Option Pricing Model 5.5: The Black-Scholes Option Pricing Model (OPM) 5.6: The Valuation of Put Options 5.7: Applications of Option Pricing in Corporate Finance Chapter 6: Accounting for Financial Management 6.1: Financial Statements and Reports 6.2: The Balance Sheet 6.3: The Income Statement 6.4: Statement of Stockholders’ Equity 6.5: Statement of Cash Flows 6.6: Net Cash Flow 6.7: Free Cash Flow: The Cash Flow Available for Distribution to Investors 6.8: Performance Evaluation 6.9: Corporate Income Taxes 6.10: Personal Taxes Chapter 7: Analysis of Financial Statements 7.1: Financial Analysis 7.2: Profitability Ratios 7.3: Asset Management Ratios 7.4: Liquidity Ratios 7.5: Debt Management Ratios 7.6: Market Value Ratios 7.7: Trend Analysis, Common Size Analysis, and Percentage Change Analysis 7.8: Tying the Ratios Together: The DuPont Equation 7.9: Comparative Ratios and Benchmarking 7.10: Uses and Limitations of Ratio Analysis 7.11: Looking Beyond the Numbers Part 2: Corporate Valuation Chapter 8: Corporate Valuation and Stock Valuation 8.1: Legal Rights and Privileges of Common Stockholders 8.2: Classified Stock and Tracking Stock 8.3: Stock Market Reporting 8.4: Valuing Common Stocks-Introducing the Free Cash Flow (FCF) Valuation Model 8.5: The Constant Growth Model: Valuation When Expected Free Cash Flow Grows at a Constant Rate 8.6: The Multistage Model: Valuation When Expected Short-Term Free Cash Flow Grows at a Nonconstant 8.7: Application of the FCF Valuation Model to MicroDrive 8.8: Do Stock Values Reflect LongTerm or Short-Term Cash Flows? 8.9: Value-Based Management: Using the Free Cash Flow Valuation Model to Identify Value Drivers 8.10: Why Are Stock Prices So Volatile? 8.11: Dividend Valuation Models 8.12: The Market Multiple Method 8.13: Comparing the FCF Valuation Model, the Dividend Growth Model, and the Market Multiple Method 1.14: Preferred Stock Chapter 9: Corporate Valuation and Financial Planning 9.1: Overview of Financial Planning 9.2: Financial Planning at MicroDrive Inc. 9.3: Forecasting Operations 9.4: Evaluating MicroDrive’s Strategic Initiatives 9.5: Projecting MicroDrive’s Financial Statements 9.6: Analysis and Selection of a Strategic Plan 9.7: The CFO’s Model 9.8: Additional Funds Needed (AFN) Equation 9.9: Forecasting When the Ratios Change Chapter 10: Corporate Governance 10.1: Agency Conflicts 10.2: Corporate Governance 10.3: Employee Stock Ownership Plans (ESOPs) Chapter 11: The Cost of Capital 11.1: The Weighted Average Cost of Capital 11.2: Choosing Weights for the Weighted Average Cost of Capital 11.3: The Cost of Debt 11.4: Cost of Preferred Stock, r 11.5: Cost of Common Stock: The Market Risk Premium, RP 11.6: Using the CAPM to Estimate the Cost of Common Stock, r 11.7: Using the Dividend Growth Approach to Estimate the Cost of Common Stock 11.8: The Weighted Average Cost of Capital (WACC) 11.9: Adjusting the Cost of Equity for Flotation Costs 11.10: Privately Owned Firms and Small Businesses 11.11: The Divisional Cost of Capital 11.12: Estimating the Cost of Capital for Individual Projects 11.13: Managerial Issues and the Cost of Capital Part 3: Project Valuation Chapter 12: Capital Budgeting: Decision Criteria 12.1: An Overview of Capital Budgeting 12.2: The First Step in Project Analysis 12.3: Net Present Value (NPV) 12.4: Internal Rate of Return (IRR) 12.5: Modified Internal Rate of Return (MIRR) 12.6: Profitability Index (PI) 12.7: Payback Period 12.8: How to Use the Different Capital Budgeting Methods 12.9: Other Issues in Capital Budgeting Chapter 13: Capital Budgeting: Estimating Cash Flows and Analyzing Risk 13.1: Identifying Relevant Cash Flows 13.2: Analysis of an Expansion Project 13.3: Risk Analysis in Capital Budgeting 13.4: Measuring Stand-Alone Risk 13.5: Sensitivity Analysis 13.6: Scenario Analysis 13.7: Monte Carlo Simulation Analysis 13.8: Project Risk Conclusions 13.9: Replacement Analysis 13.10: Phased Decisions and Decision Trees 13.11: Other Real Options Chapter 13A: Depreciation for Tax Purposes Chapter 14: Real Options 14.1: Valuing Real Options 14.2: The Investment Timing Option: An Illustration 14.3: The Growth Option: An Illustration 14.4: Concluding Thoughts on Real Options Part 4: Strategic Financing Decisions Chapter 15: Distributions to Shareholders: Dividends and Repurchases 15.1: An Overview of Cash Distributions 15.2: Procedures for Cash Distributions 15.3: Cash Distributions and Firm Value 15.4: Clientele Effect 15.5: Signaling Hypothesis 15.6: Implications for Dividend Stability 15.7: Setting the Target Distribution Level: The Residual Distribution Model 15.8: The Residual Distribution Model in Practice 15.9: A Tale of Two Cash Distributions: Dividends versus Stock Repurchases 15.10: The Pros and Cons of Dividends and Repurchases 15.11: Other Factors Influencing Distributions 15.12: Summarizing the Distribution Policy Decision 15.13: Stock Splits and Stock Dividends 15.14: Dividend Reinvestment Plans Chapter 16: Capital Structure Decisions 16.1: An Overview of Capital Structure 16.2: Business Risk and Financial Risk 16.3: Capital Structure Theory: The Modigliani and Miller Models 16.4: Capital Structure Theory: Beyond the Modigliani and Miller Models 16.5: Capital Structure Evidence and Implications 16.6: Estimating the Optimal Capital Structure 16.7: Anatomy of a Recapitalization 16.8: Risky Debt and Equity as an Option 16.9: Managing the Maturity Structure of Debt Chapter 17: Dynamic Capital Structures and Corporate Valuation 17.1: The Adjusted Present Value (APV) Approach 17.2: The Modigliani and Miller Models 17.3: The Compressed Adjusted Present Value (CAPV) Model 17.4: The Free Cash Flow to Equity (FCFE) Model 17.5: Multistage Valuation When the Capital Structure Is Stable 17.6: Illustration of the Three Valuation Approaches for a Constant Capital Structure 17.7: Analysis of a Dynamic Capital Structure Part 5: Tactical Financing Decisions Chapter 18: Initial Public Offerings, Investment Banking, and Financial Restructuring 18.1: The Financial Life Cycle of a Start-Up Company 18.2: The Decision to Go Public 18.3: The Process of Going Public: An Initial Public Offering 18.4: Equity Carve-Outs: A Special Type of IPO 18.5: Other Ways to Raise Funds in the Capital Markets 18.6: Investment Banking Activities 18.7: The Decision to Go Private Chapter 19: Lease Financing 19.1: Types of Leases 19.2: Reporting Leases on Financial Statements 19.3: Lease Analysis: Determination of Tax Status by the Internal Revenue Service (IRS) 19.4: Lease Analysis: Non-TaxOriented Leases 19.5: Lease Analysis: Tax-Oriented Lease 19.6: Evaluation by the Lessor 19.7: Leases, Taxes, and the 2017 Tax Cuts and Jobs Act 19.8: Other Issues in Lease Analysis 19.9: Other Reasons for Leasing Chapter 20: Hybrid Financing: Preferred Stock, Warrants, and Convertibles 20.1: Preferred Stock 20.2: Warrants 20.3: Convertible Securities 20.4: A Final Comparison of Warrants and Convertibles 20.5: Reporting Earnings When Warrants or Convertibles Are Outstanding Part 6: Working Capital Management Chapter 21: Supply Chains and Working Capital Management 21.1: Overview of Supply Chain Management 21.2: Using and Financing Operating Current Assets 21.3: The Cash Conversion Cycle 21.4: Inventory Management 21.5: Receivables Management 21.6: Accruals and Accounts Payable (Trade Credit) 21.7: The Cash Budget 21.8: Cash Management and the Target Cash Balance 21.9: Cash Management Techniques 21.10: Managing Short-Term Investments 21.11: Short-Term Bank Loans 21.12: Commercial Paper 21.13: Use of Security in Short-Term Financing Chapter 22: Providing and Obtaining Credit 22.1: Credit Policy 22.2: Monitoring Receivables with the Uncollected Balances Schedule 22.3: Analyzing Proposed Changes in Credit Policy 22.4: Analyzing Proposed Changes in Credit Policy: Incremental Analysis 22.5: The Cost of Bank Loans 22.6: Choosing a Bank Chapter 23: Other Topics in Working Capital Management 23.1: The Concept of Zero Working Capital 23.2: Setting the Target Cash Balance 23.3: Inventory Control Systems 23.4: Accounting for Inventory 23.5: The Economic Ordering Quantity (EOQ) Model 23.6: EOQ Model Extensions Part 7: Special Topics Chapter 24: Enterprise Risk Management 24.1: Reasons to Manage Risk 24.2: An Overview of Enterprise Risk Management 24.3: A Framework for Enterprise Risk Management 24.4: Categories of Risk Events 24.5: Foreign Exchange (FX) Risk 24.6: Commodity Price Risk 24.7: Interest Rate Risk 24.8: Project Selection Risks 24.9: Managing Credit Risks 24.10: Risk and Human Safety Chapter 25: Bankruptcy, Reorganization, and Liquidation 25.1: Financial Distress and Its Consequences 25.2: Issues Facing a Firm in Financial Distress 25.3: Settlements without Going through Formal Bankruptcy 25.4: Federal Bankruptcy Law 25.5: Reorganization in Bankruptcy (Chapter 11 of Bankruptcy Code) 25.6: Liquidation in Bankruptcy 25.7: Anatomy of a Bankruptcy: Transforming the GM Corporation into the GM 25.8: Other Motivations for Bankruptcy 25.9: Some Criticisms of Bankruptcy Laws Chapter 26: Mergers and Corporate Control 26.1: Rationale for Mergers 26.2: Types of Mergers: Business Types, Acquisition Methods, and Hidden Liabilities 26.3: Level of Merger Activity 26.4: Hostile versus Friendly Takeovers 26.5: Merger Regulation 26.6: Overview of Merger Analysis 26.7: Estimating a Target’s Value 26.8: Setting the Bid Price 26.9: Who Wins: The Empirical Evidence 26.10: The Role of Investment Bankers 26.11: Other Business Combinations 26.12: Divestitures 26.13: Merger Tax Treatments 26.14: Financial Reporting for Mergers Chapter 27: Multinational Financial Management* 27.1: Multinational, or Global, Corporations 27.2: Multinational versus Domestic Financial Management 27.3: Exchange Rates 27.4: The Fixed Exchange Rate System 27.5: Floating Exchange Rates 27.6: Government Intervention in Foreign Exchange Markets 27.7: Other Exchange Rate Systems: No Local Currency, Pegged Rates, and Managed Floating Rates 27.8: Forward Exchange Rates and Risk Management 27.9: Interest Rate Parity 27.10: Purchasing Power Parity 27.11: Inflation, Interest Rates, and Exchange Rates 27.12: International Money and Capital Markets 27.13: Multinational Capital Budgeting 27.14: International Capital Structures 27.15: Multinational Working Capital Management [Show More]

Last updated: 11 months ago

Preview 1 out of 581 pages

Reviews( 0 )

Recommended For You

Management> TEST BANK > Test Bank For Management, 14th Edition By Schermerhor, Bachrach (All)

Test Bank For Management, 14th Edition By Schermerhor, Bachrach

Schermerhorn, Management 14e continues to offer the same balanced theory approach as with previous editions. Students need an active and engaged learning classroom environment that brings personal mea...

By studenthelp , Uploaded: Sep 26, 2023

$20.5

Management> TEST BANK > Test Bank For Management, 14th Edition By Richard Daft (All)

Test Bank For Management, 14th Edition By Richard Daft

Develop with the confidence and innovative skills to lead in today's rapidly changing, turbulent business environment with Daft's market-leading MANAGEMENT, 14E. This reader-friendly presentation blen...

By studenthelp , Uploaded: Jul 22, 2023

$20

Business Law> TEST BANK > Operations Management Sustainability and Supply Chain Management, 14th edition By Jay Heizer, Barry Render, Chuck Munson (Test Bank ) (All)

Operations Management Sustainability and Supply Chain Management, 14th edition By Jay Heizer, Barry Render, Chuck Munson (Test Bank )

PART 1: INTRODUCTION TO OPERATIONS MANAGEMENT Operations and Productivity Operations Strategy in a Global Environment Project Management Forecasting PART 2: DESIGNING OPERATIONS Design of Goods...

By eBookSmTb , Uploaded: Nov 04, 2022

$25

Management> TEST BANK > Management, 14th Edition by Schermerhorn Test Bank (All)

Management, 14th Edition by Schermerhorn Test Bank

Test Bank for Management, 14th Edition, 14e by John R. Schermerhorn TEST BANK ISBN-13: 9781119497721 Full chapters included Part 1: Management Chapter 1: Management Today Chapter 2: Managem...

By Test-Bank Lounge , Uploaded: Sep 29, 2022

$35

Operations Management> TEST BANK > Test Bank Operations Management, 14th Edition by Stevenson (All)

Test Bank Operations Management, 14th Edition by Stevenson

Test Bank for Operations Management, 14e, 14th Edition by William J. Stevenson TEST BANK ISBN-13: 9781260238891 FULL CHAPTERS INCLUDED Ch. 1 Introduction to Operations Management Ch. 2 Competi...

By Test-Bank Lounge , Uploaded: Dec 12, 2022

$35

Business> TEST BANK > Investments Analysis and Management, 14th Edition by Jones Test Bank (All)

Investments Analysis and Management, 14th Edition by Jones Test Bank

Test Bank for Investments Analysis and Management, 14th Edition, 14e by Charles P. Jones TEST BANK ISBN-13: 9781119578123 Full chapters included 1 Understanding Investments 1 An Overall Pers...

By Test-Bank Lounge , Uploaded: Sep 27, 2022

$35

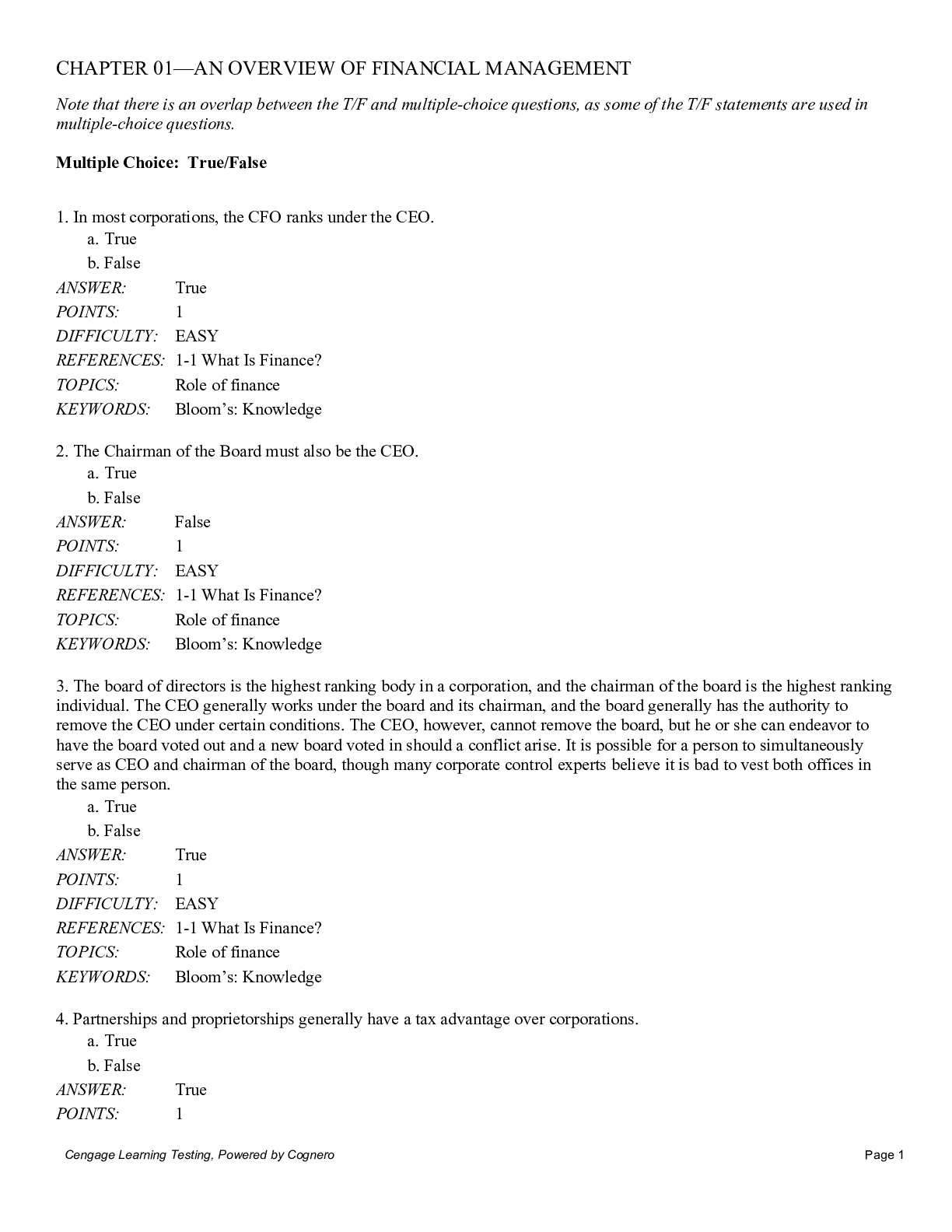

Management> TEST BANK > Financial Management Theory & Practice, 16th Edition by Brigham Test Bank (All)

Financial Management Theory & Practice, 16th Edition by Brigham Test Bank

Test Bank for Financial Management Theory & Practice, 16th Edition, 10e by Eugene F. Brigham, Michael C. Ehrhardt TEST BANK ISBN-13: 9781337902601 Full chapters included Part 1: The Company and I...

By Test-Bank Lounge , Uploaded: Sep 20, 2022

$35

Operations Management> TEST BANK > Test Bank Operations Management, 14th Edition by Heizer (All)

Test Bank Operations Management, 14th Edition by Heizer

Test Bank for Operations Management, 14th edition, 14e by Jay Heizer,Barry Render TEST BANK ISBN-13: 9780137649136 FULL CHAPTERS INCLUDED PART 1: INTRODUCTION TO OPERATIONS MANAGEMENT Operatio...

By Test-Bank Lounge , Uploaded: Dec 12, 2022

$35

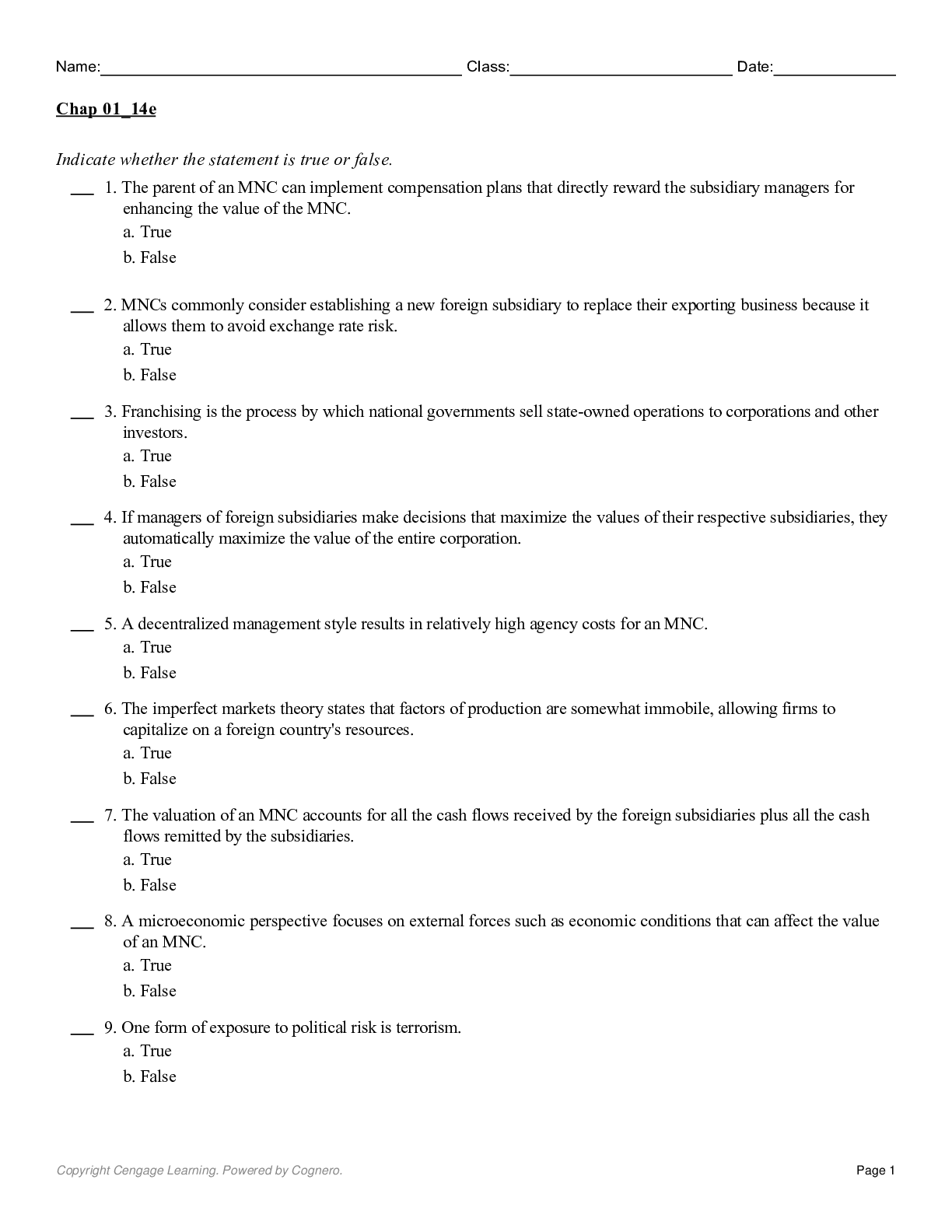

Management> TEST BANK > International Financial Management, 14th Edition by Madura Test Bank (All)

International Financial Management, 14th Edition by Madura Test Bank

Test Bank for International Financial Management, 14th Edition, 14e by Jeff Madura TEST BANK ISBN-13: 9780357451106 Full chapters included Part 1: The International Financial Environment Chapt...

By Test-Bank Lounge , Uploaded: Sep 20, 2022

$35

Finance> TEST BANK > Essentials of Financial Management, 4th Edition by Brigham Test Bank (All)

Essentials of Financial Management, 4th Edition by Brigham Test Bank

Test Bank for Essentials of Financial Management, 4th Edition, 4e by Eugene F. Brigham, Joel F. Houston, Jun-Ming Hsu, Yoon Kee Kong, A.N. Bany-Ariffin TEST BANK ISBN-13: 9789814792080 Full chapters...

By Test-Bank Lounge , Uploaded: Sep 13, 2022

$35

Document information

Connected school, study & course

About the document

Uploaded On

Dec 07, 2022

Number of pages

581

Written in

Additional information

This document has been written for:

Uploaded

Dec 07, 2022

Downloads

0

Views

73