Management > TEST BANK > Income Tax Fundamentals 2022, 40th Edition by Whittenburg Test Bank (All)

Income Tax Fundamentals 2022, 40th Edition by Whittenburg Test Bank

Document Content and Description Below

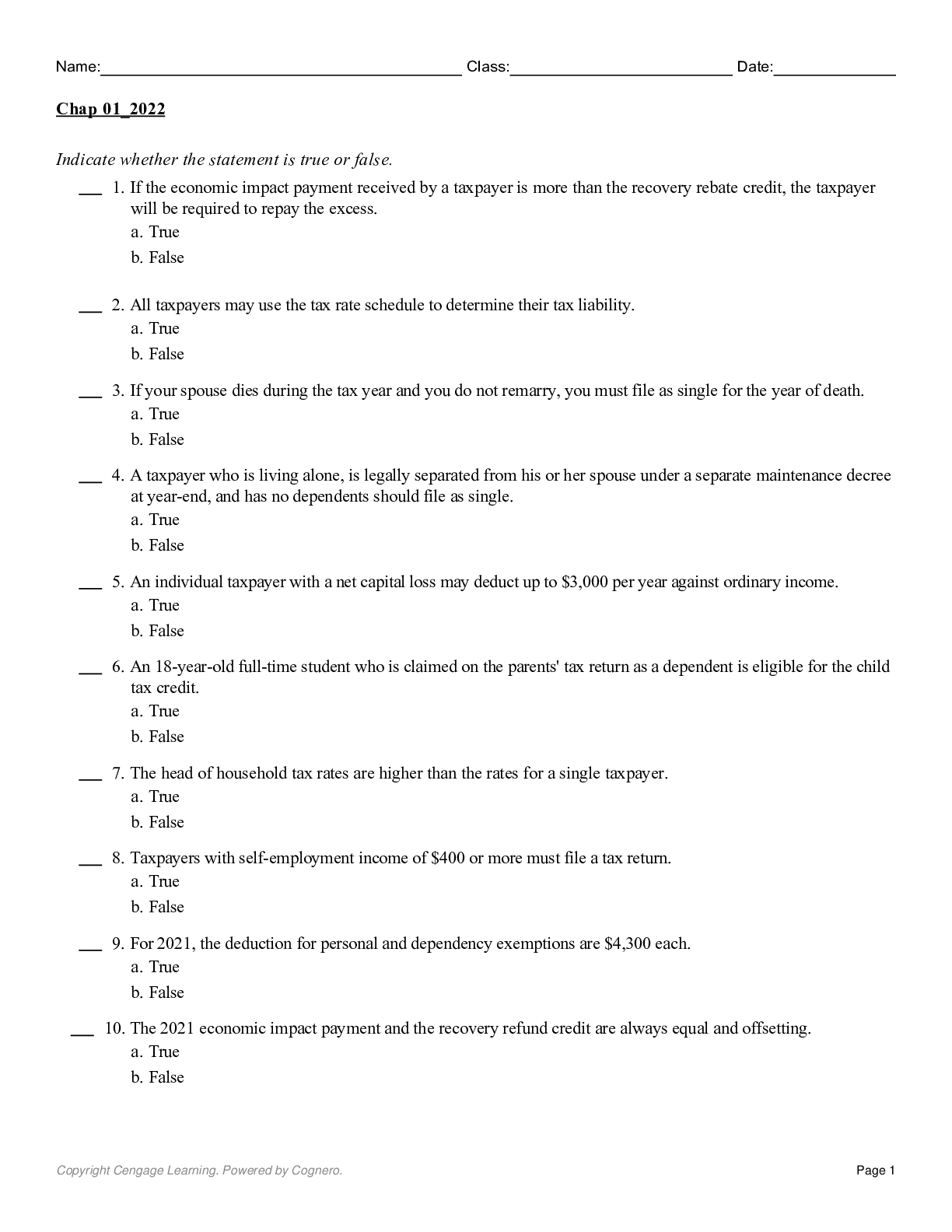

Test Bank for Income Tax Fundamentals 2022, 40th Edition, 40e by Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill TEST BANK ISBN-13: 9780357516386 FULL CHAPTERS INCLUDED Chapter 1: The I... ndividual Income Tax Return 1-1 History and Objectives of the Tax System 1-2 Reporting and Taxable Entities 1-3 The Tax Formula for Individuals 1-4 Who Must File 1-5 Filing Status and Tax Computation 1-6 Qualifying Dependents 1-7 Economic Impact Payment and Recovery Rebate Credit 1-10 Tax and the Internet 1-11 Electronic Filing (e-Filing) Questions and Problems Chapter 2: Gross Income and Exclusions 2-1 The Nature of Gross Income 2-2 Salaries and Wages 2-3 Accident and Health Insurance 2-4 Meals and Lodging 2-5 Employee Fringe Benefits 2-6 Prizes and Awards 2-7 Annuities 2-8 Life Insurance 2-9 Interest and Dividend Income 2-10 Municipal Bond Interest 2-11 Gifts and Inheritances 2-14 Educational Incentives 2-15 Unemployment Compensation 2-16 Social Security Benefits 2-17 Community Property 2-18 Forgiveness of Debt Income Questions and Problems Chapter 3: Business Income and Expenses 3-1 Schedule C 3-2 Inventories 3-3 Transportation 3-4 Travel Expenses 3-5 Meals and Entertainment 3-6 Educational Expenses 3-7 Dues, Subscriptions, and Publications 3-8 Special Clothing and Uniforms 3-9 Business Gifts 3-10 Bad Debts 3-11 Office in the Home 3-12 Hobby Losses Questions and Problems Chapter 4: Additional Income and the Qualified Business Income Deduction 4-1 What Is a Capital Asset? 4-2 Holding Period 4-3 Calculation of Gain or Loss 4-4 Net Capital Gains 4-5 Net Capital Losses 4-6 Sale of a Personal Residence 4-7 Rental Income and Expenses 4-8 Passive Loss Limitations 4-9 Net Operating Losses 4-10 Qualified Business Income (QBI) Deduction Questions and Problems Chapter 5: Deductions for and from AGI 5-1 Health Savings Accounts 5-2 Self-Employed Health Insurance Deduction 5-3 Individual Retirement Accounts 5-4 Small Business and Self-Employed Retirement Plans 5-5 Other for AGI Deductions 5-6 Medical Expenses 5-7 Taxes 5-8 Interest 5-9 Charitable Contributions 5-10 Other Itemized Deductions Questions and Problems Chapter 6: Accounting Periods and Other Taxes 6-1 Accounting Periods 6-2 Accounting Methods 6-3 Related Parties (Section 267) 6-4 Unearned Income of Minor Children and Certain Students 6-5 The Individual Alternative Minimum Tax (AMT) 6-6 Self-Employment Tax 6-7 The Nanny Tax 6-8 Special Taxes for High-Income Taxpayers Questions and Problems Chapter 7: Tax Credits 7-1 Child Tax Credit 7-2 Earned Income Credit 7-3 Child and Dependent Care Credit 7-4 The Affordable Care Act 7-5 Education Tax Credits 7-6 Foreign Exclusion and Tax Credit 7-7 Adoption Expenses 7-8 Energy Credits 7-9 Low-Income Retirement Plan Contribution Credit Questions and Problems Chapter 8: Depreciation and Sale of Business Property 8-1 Depreciation 8-2 Modified Accelerated Cost Recovery System (MACRS) and Bonus Depreciation 8-3 Election to Expense (Section 179) 8-4 Listed Property 8-5 Limitation on Depreciation of Luxury Automobiles 8-6 Intangibles 8-7 Section 1231 Gains and Losses 8-8 Depreciation Recapture 8-9 Business Casualty Gains and Losses 8-10 Installment Sales 8-11 Like-Kind Exchanges 8-12 Involuntary Conversions Questions and Problems Chapter 9: Payroll, Estimated Payments, and Retirement Plans 9-1 Withholding Methods 9-2 Estimated Payments 9-3 The FICA Tax 9-4 Federal Tax Deposit System 9-5 Employer Reporting Requirements 9-6 The FUTA Tax 9-7 Qualified Retirement Plans 9-8 Rollovers Questions and Problems Chapter 10: Partnership Taxation 10-1 Nature of Partnership Taxation 10-2 Partnership Formation 10-3 Partnership Income Reporting 10-4 Current Distributions and Guaranteed Payments 10-5 Tax Years 10-6 Transactions between Partners and the Partnership 10-7 Qualified Business Income Deduction for Partners 10-8 The At-Risk Rule 10-9 Limited Liability Companies Questions and Problems Chapter 11: The Corporate Income Tax 11-1 Corporate Tax Rates 11-2 Corporate Gains and Losses 11-3 Special Deductions and Limitations 11-4 Schedule M-1 11-5 Filing Requirements and Estimated Tax 11-6 S Corporations 11-7 Corporate Formation 11-8 Corporate Accumulations Questions and Problems Chapter 12: Tax Administration and Tax Planning 12-1 The Internal Revenue Service 12-2 The Audit Process 12-3 Interest and Penalties 12-4 Statute of Limitations 12-5 Preparers, Proof, and Privilege 12-6 The Taxpayer Bill of Rights 12-7 Tax Planning [Show More]

Last updated: 10 months ago

Preview 1 out of 334 pages

Reviews( 0 )

Recommended For You

Accounting> TEST BANK > Test Bank for Income Tax Fundamentals 2021 39th Edition by Whittenburg, Altus-Buller, Gill (All)

Test Bank for Income Tax Fundamentals 2021 39th Edition by Whittenburg, Altus-Buller, Gill

1. Noncash items received as income must be included in income at their fair market value. a. True b. False ANSWER: True 2. Awards, bonuses, and gifts are all included in gross income....

By Kevin , Uploaded: May 01, 2021

$10

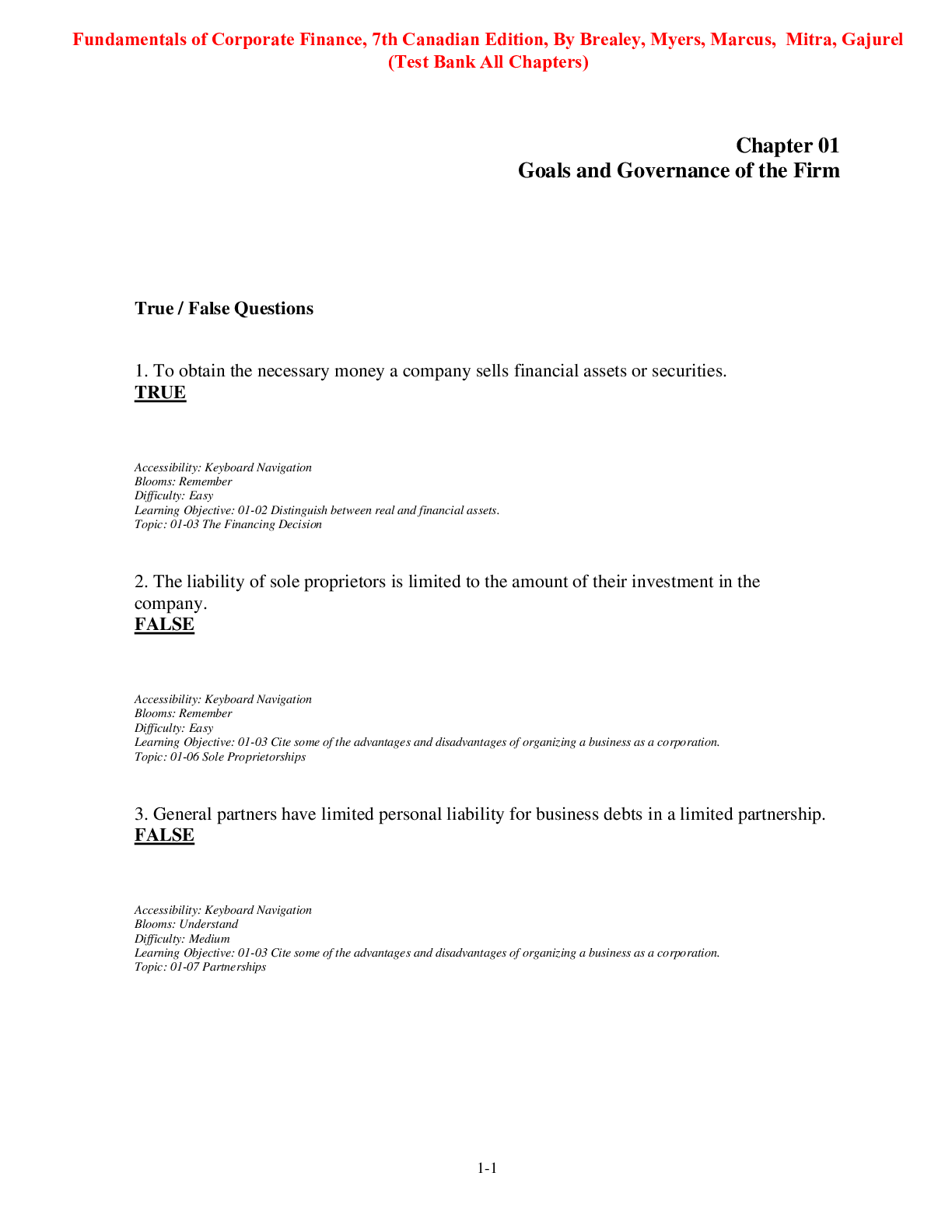

Finance> TEST BANK > Fundamentals of Corporate Finance 7th Canadian Edition By Brealey, Myers, Marcus, Mitra, Gajurel (Test Bank) (All)

Fundamentals of Corporate Finance 7th Canadian Edition By Brealey, Myers, Marcus, Mitra, Gajurel (Test Bank)

Fundamentals of Corporate Finance, 7th Canadian Edition, By Brealey, Myers, Marcus, Mitra, Gajurel (Test Bank) Fundamentals of Corporate Finance, 7th Canadian Edition, By Brealey, Myers, Marcus, Mi...

By eBookSmTb , Uploaded: Oct 22, 2023

$25

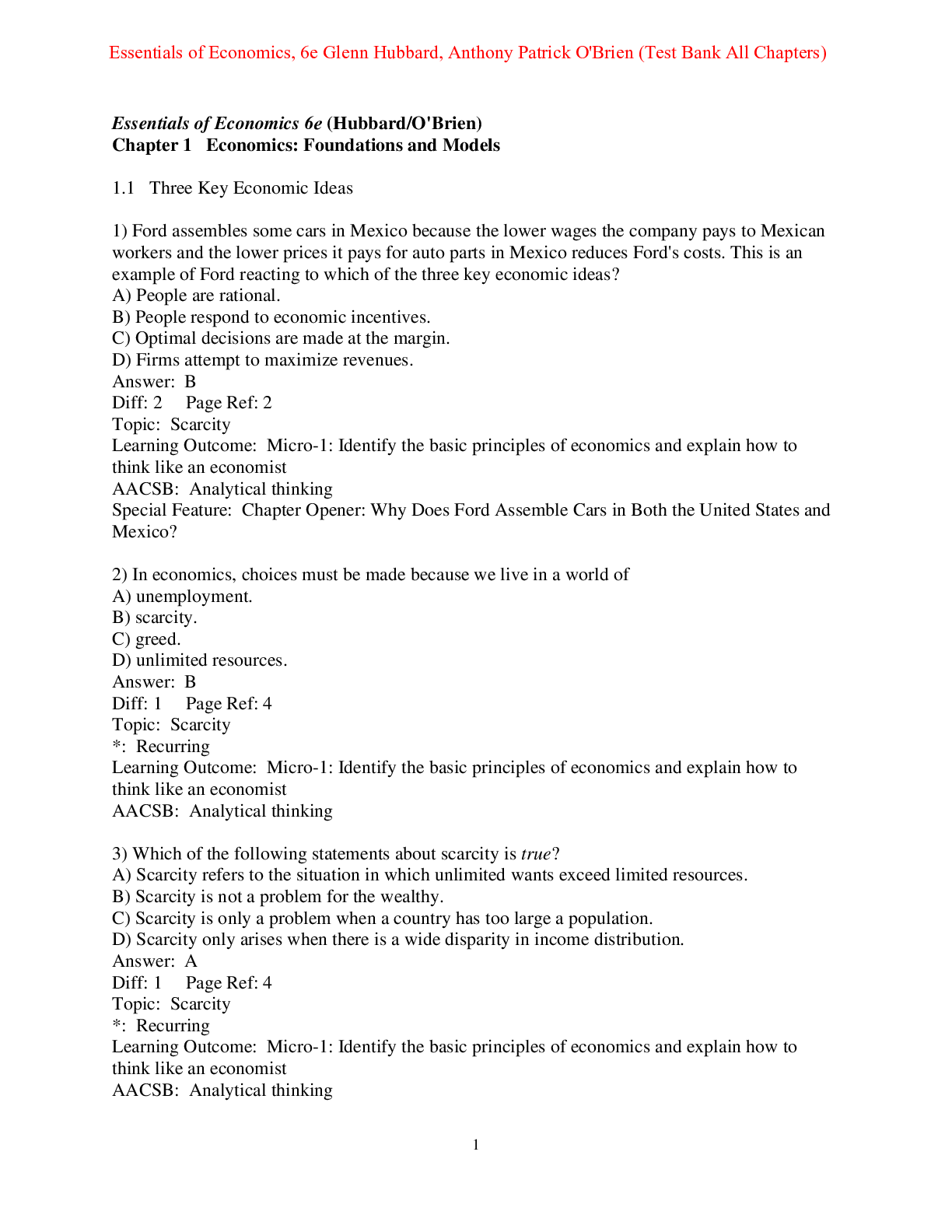

Economics> TEST BANK > Essentials of Economics 6th Edition By Glenn Hubbard, Anthony Patrick O'Brien (Test Bank) (All)

Essentials of Economics 6th Edition By Glenn Hubbard, Anthony Patrick O'Brien (Test Bank)

Essentials of Economics, 6e Glenn Hubbard, Anthony Patrick O'Brien (Test Bank) Essentials of Economics, 6e Glenn Hubbard, Anthony Patrick O'Brien (Test Bank) Essentials of Economics, 6e Glenn Hubb...

By eBookSmTb , Uploaded: Oct 22, 2023

$20

Economics> TEST BANK > Economics 3rd Edition By Dean Karlan, Jonathan Morduch (Test Bank, 100% Original Verified, A+ Grade) (All)

Economics 3rd Edition By Dean Karlan, Jonathan Morduch (Test Bank, 100% Original Verified, A+ Grade)

Economics, 3e Dean Karlan, Jonathan Morduch (Test Bank, 100% Original Verified, A+ Grade) Economics, 3e Dean Karlan, Jonathan Morduch (Test Bank, 100% Original Verified, A+ Grade) Economics, 3e Dean...

By eBookSmTb , Uploaded: Oct 18, 2023

$25

Economics> TEST BANK > Economics Private & Public Choice 17th Edition By James Gwartney, Richard Stroup, Russell Sobel, David Macpherson (Test Bank) (All)

Economics Private & Public Choice 17th Edition By James Gwartney, Richard Stroup, Russell Sobel, David Macpherson (Test Bank)

Economics Private & Public Choice, 17e James Gwartney, Richard Stroup, Russell Sobel, David Macpherson (Test Bank) Economics Private & Public Choice, 17e James Gwartney, Richard Stroup, Russell Sobe...

By eBookSmTb , Uploaded: Oct 18, 2023

$25

Computer Science> TEST BANK > Core Concepts in Health 4th Canadian Edition By Jennifer Irwin (Test Bank) (All)

Core Concepts in Health 4th Canadian Edition By Jennifer Irwin (Test Bank)

Core Concepts in Health, 4th Canadian Edition By Jennifer Irwin (Test Bank) Core Concepts in Health, 4th Canadian Edition By Jennifer Irwin (Test Bank) Core Concepts in Health, 4th Canadian Edition...

By eBookSmTb , Uploaded: Oct 18, 2023

$25

Chemistry> TEST BANK > Chemistry Structures and Properties 2nd Edition By Nivaldo J. Tro (Test Bank) (All)

Chemistry Structures and Properties 2nd Edition By Nivaldo J. Tro (Test Bank)

Chemistry Structures and Properties, 2e Nivaldo J. Tro (Test Bank) Chemistry Structures and Properties, 2e Nivaldo J. Tro (Test Bank) Chemistry Structures and Properties, 2e Nivaldo J. Tro (Test Ban...

By eBookSmTb , Uploaded: Oct 18, 2023

$25

Accounting> TEST BANK > Byrd & Chen's Canadian Tax Principles, 2023-2024 Edition (Volume 2) 1st Edition By Gary Donell, Clarence Byrd, Ida Chen (Test Bank Updated October 2023) (All)

Byrd & Chen's Canadian Tax Principles, 2023-2024 Edition (Volume 2) 1st Edition By Gary Donell, Clarence Byrd, Ida Chen (Test Bank Updated October 2023)

Byrd & Chen's Canadian Tax Principles, 2023-2024 Edition, (Volume 2) 1e Gary Donell, Clarence Byrd, Ida Chen (Test Bank Updated October 2023) Byrd & Chen's Canadian Tax Principles, 2023-2024 Edition,...

By eBookSmTb , Uploaded: Oct 18, 2023

$20

Accounting> TEST BANK > Byrd & Chen's Canadian Tax Principles, 2023-2024 Edition (Volume 1) 1st Edition By Gary Donell, Clarence Byrd, Ida Chen (Test Bank Updated October 2023) (All)

Byrd & Chen's Canadian Tax Principles, 2023-2024 Edition (Volume 1) 1st Edition By Gary Donell, Clarence Byrd, Ida Chen (Test Bank Updated October 2023)

Byrd & Chen's Canadian Tax Principles, 2023-2024 Edition, (Volume 1) 1e Gary Donell, Clarence Byrd, Ida Chen (Test Bank Updated October 2023) Byrd & Chen's Canadian Tax Principles, 2023-2024 Edition,...

By eBookSmTb , Uploaded: Oct 18, 2023

$20

Biology> TEST BANK > Biological Psychology 14th Edition By James Kalat (Test Bank) (All)

Biological Psychology 14th Edition By James Kalat (Test Bank)

Biological Psychology, 14e James Kalat (Test Bank) Biological Psychology, 14e James Kalat (Test Bank) Biological Psychology, 14e James Kalat (Test Bank) Biological Psychology, 14e James Kalat (Test...

By eBookSmTb , Uploaded: Oct 18, 2023

$25

Document information

Connected school, study & course

About the document

Uploaded On

Dec 07, 2022

Number of pages

334

Written in

Additional information

This document has been written for:

Uploaded

Dec 07, 2022

Downloads

0

Views

81