Health Care > Quiz > HSM 340 Week 7 Quiz (GRADED A) Questions and Answers | 100% verified solutions (All)

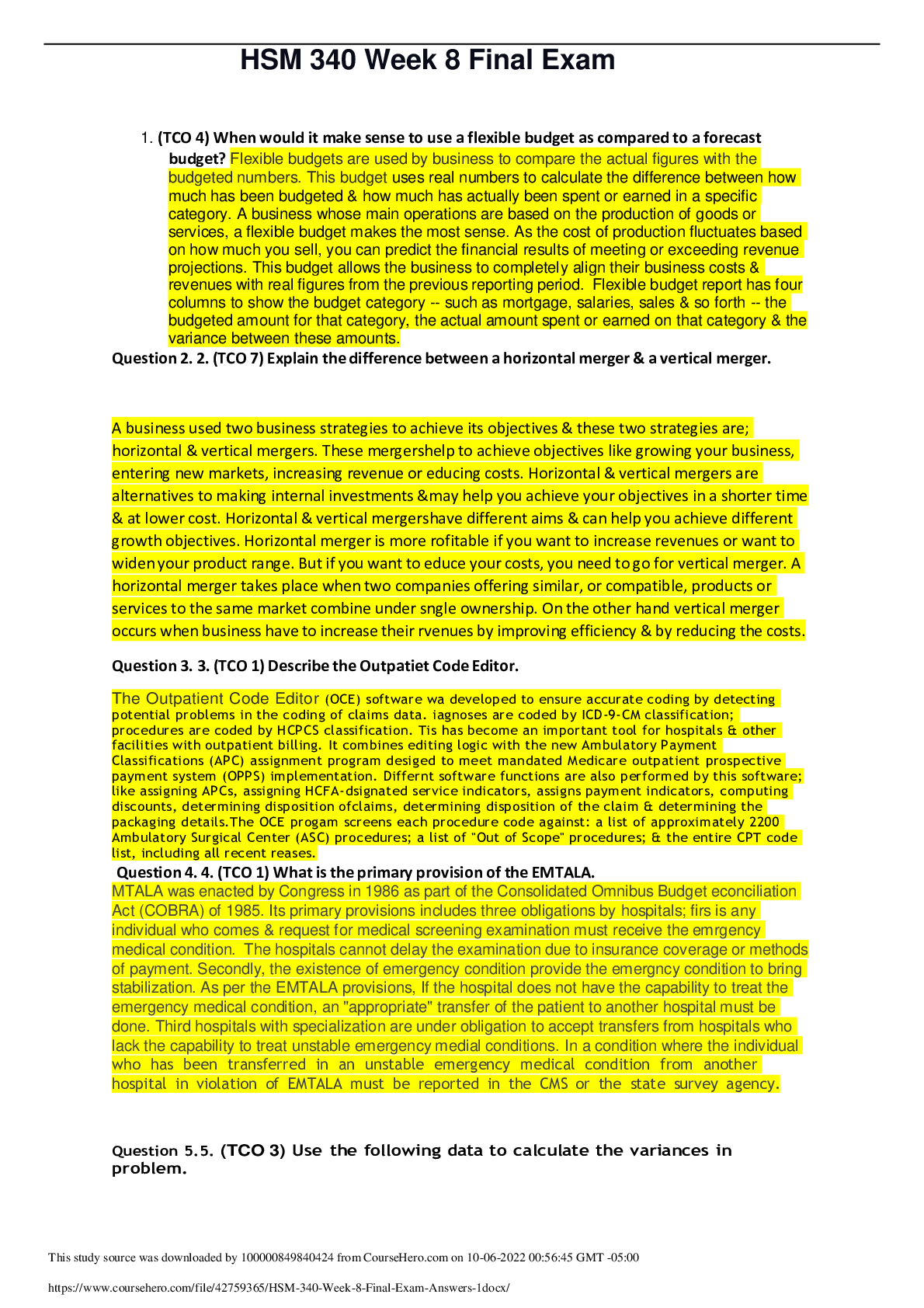

HSM 340 Week 7 Quiz (GRADED A) Questions and Answers | 100% verified solutions

Document Content and Description Below

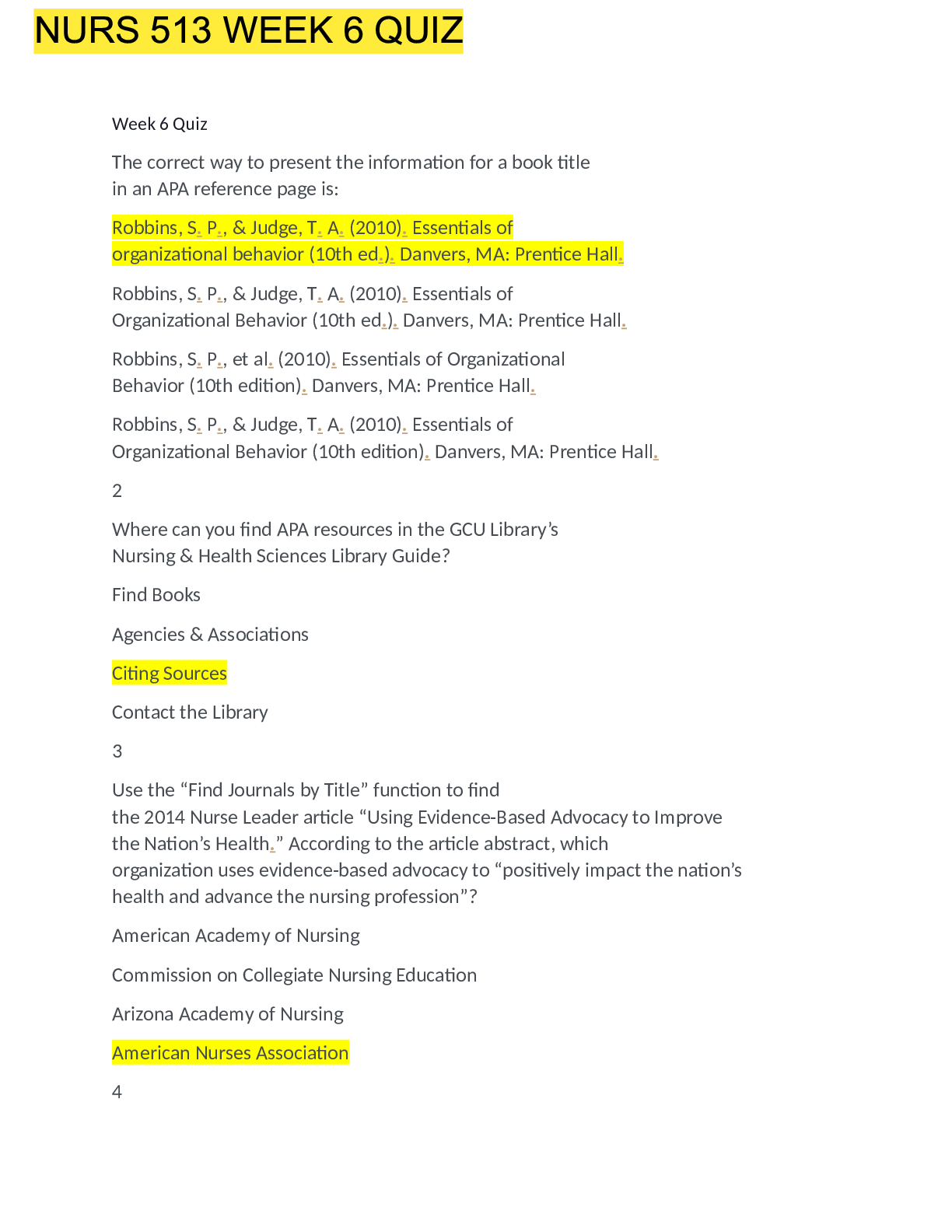

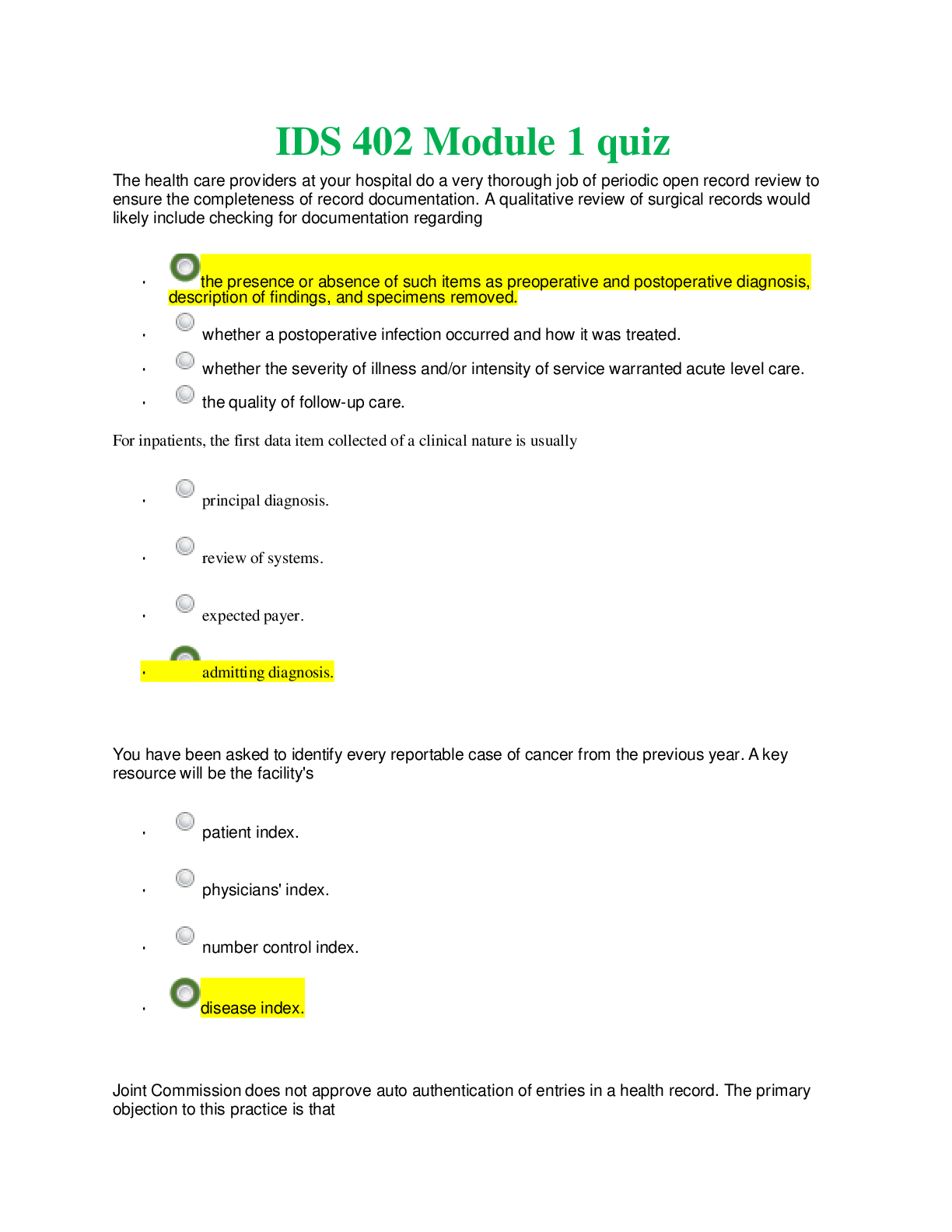

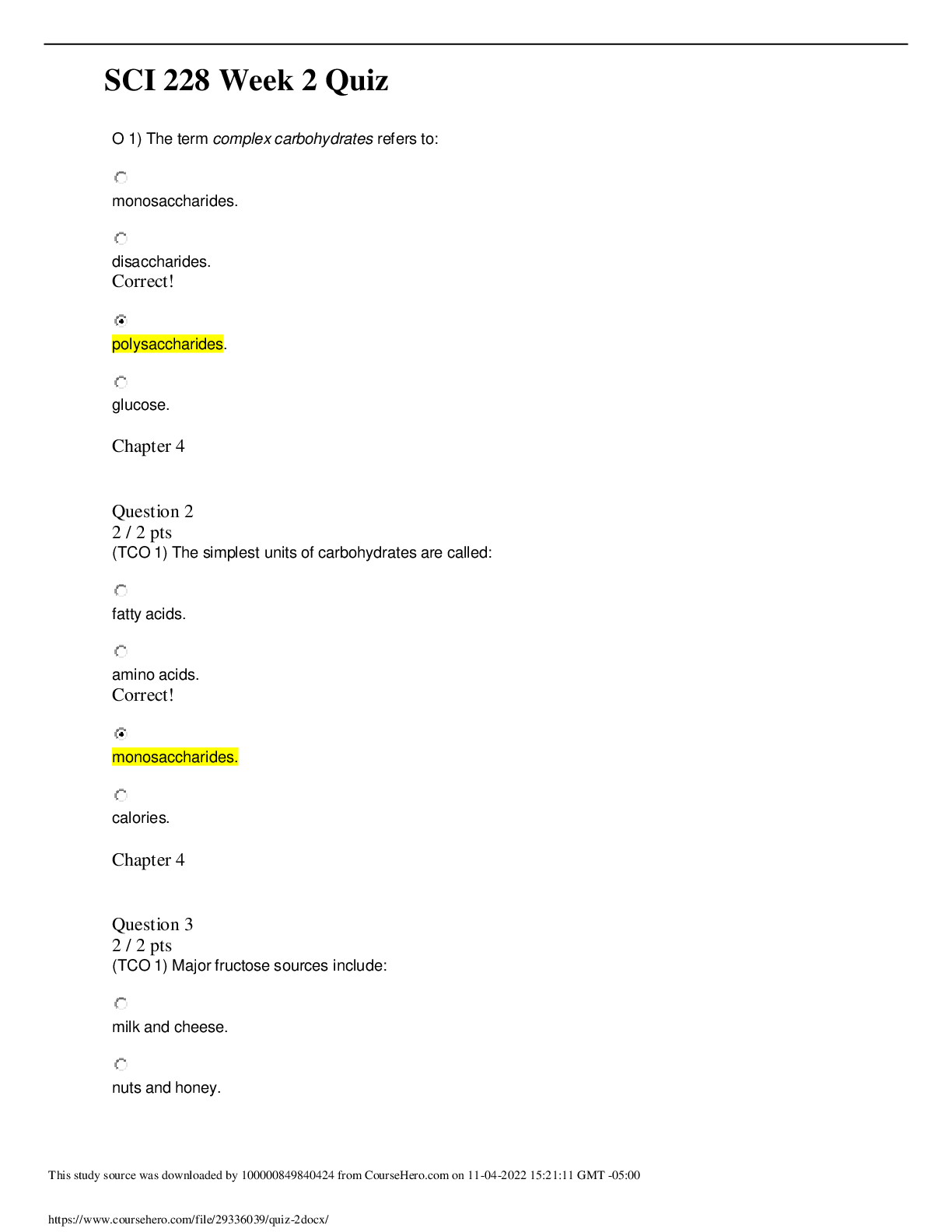

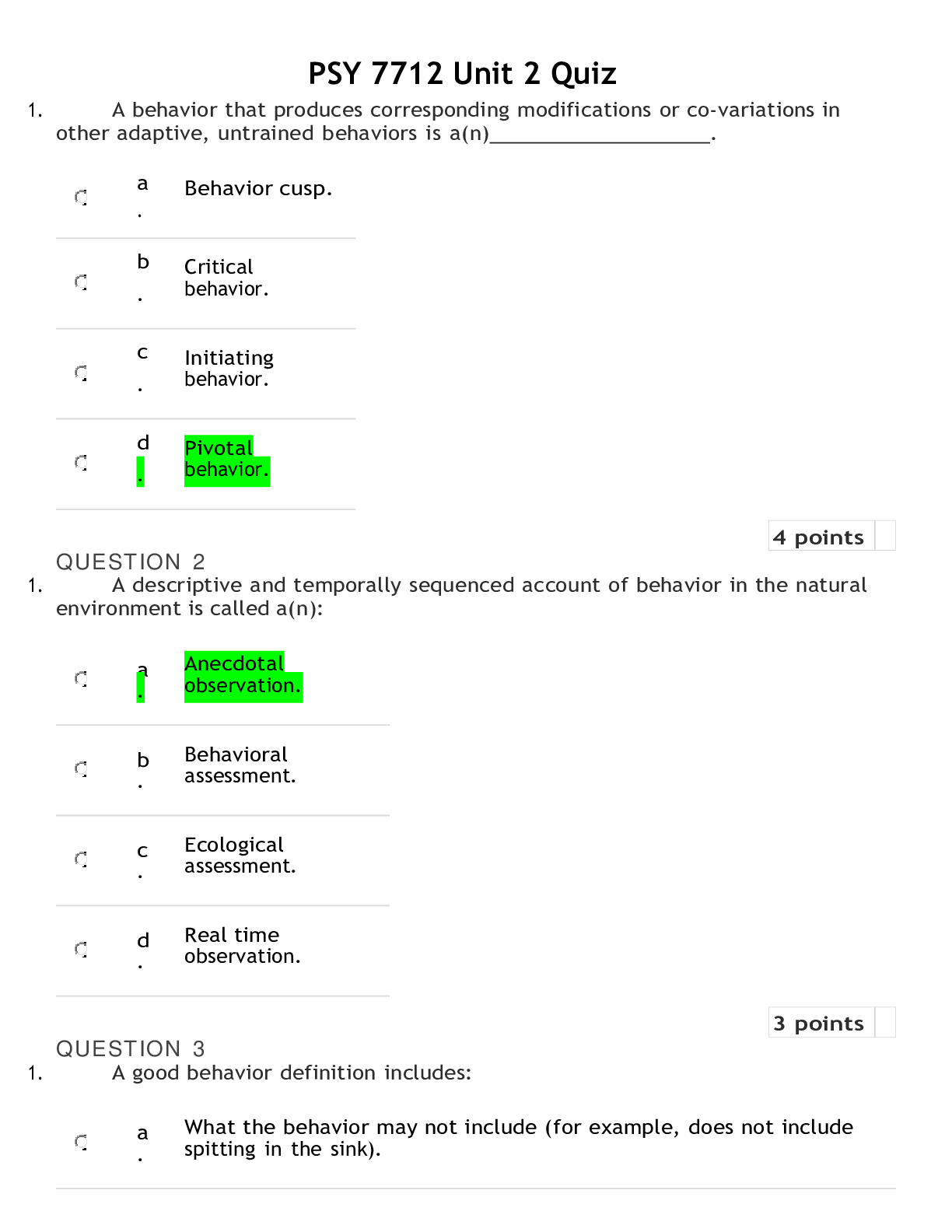

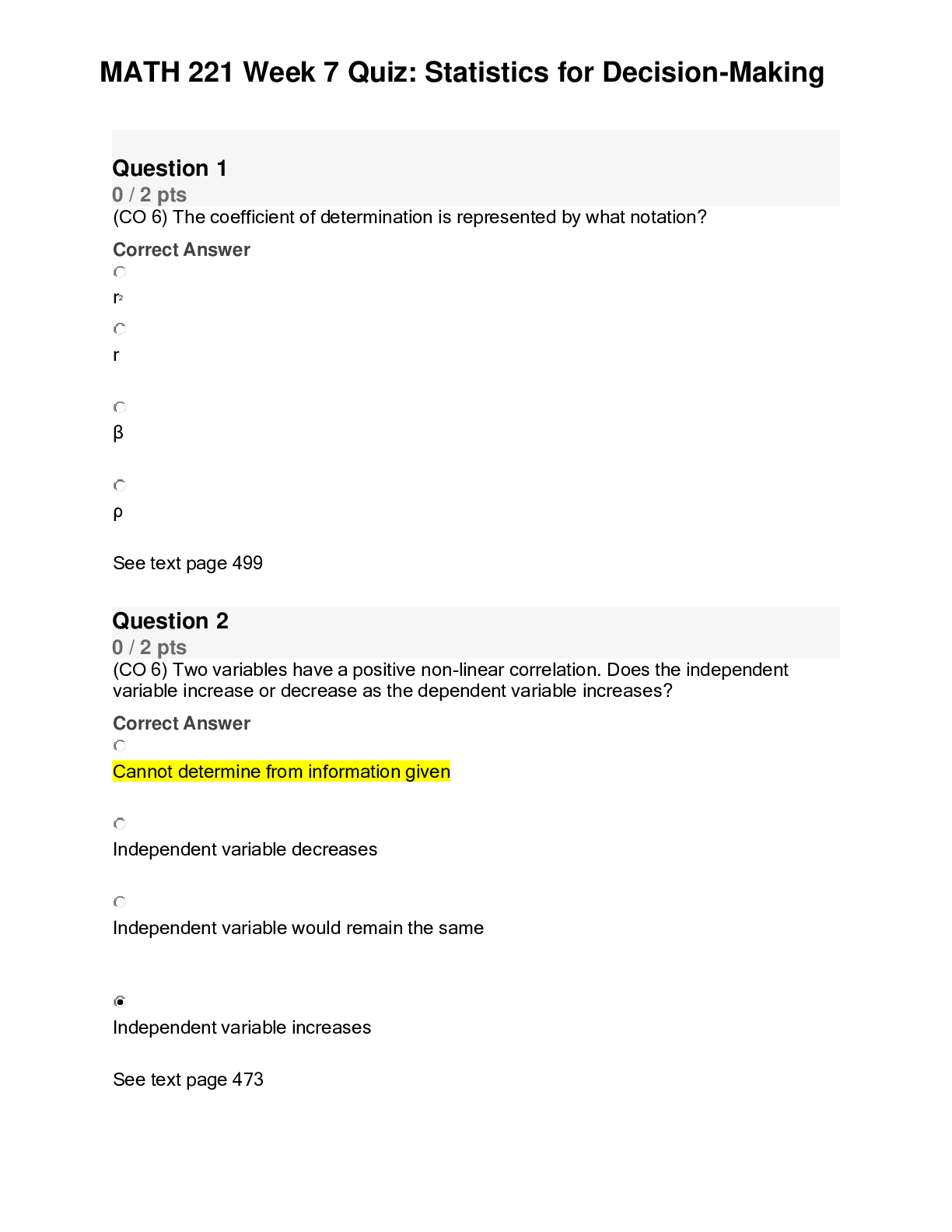

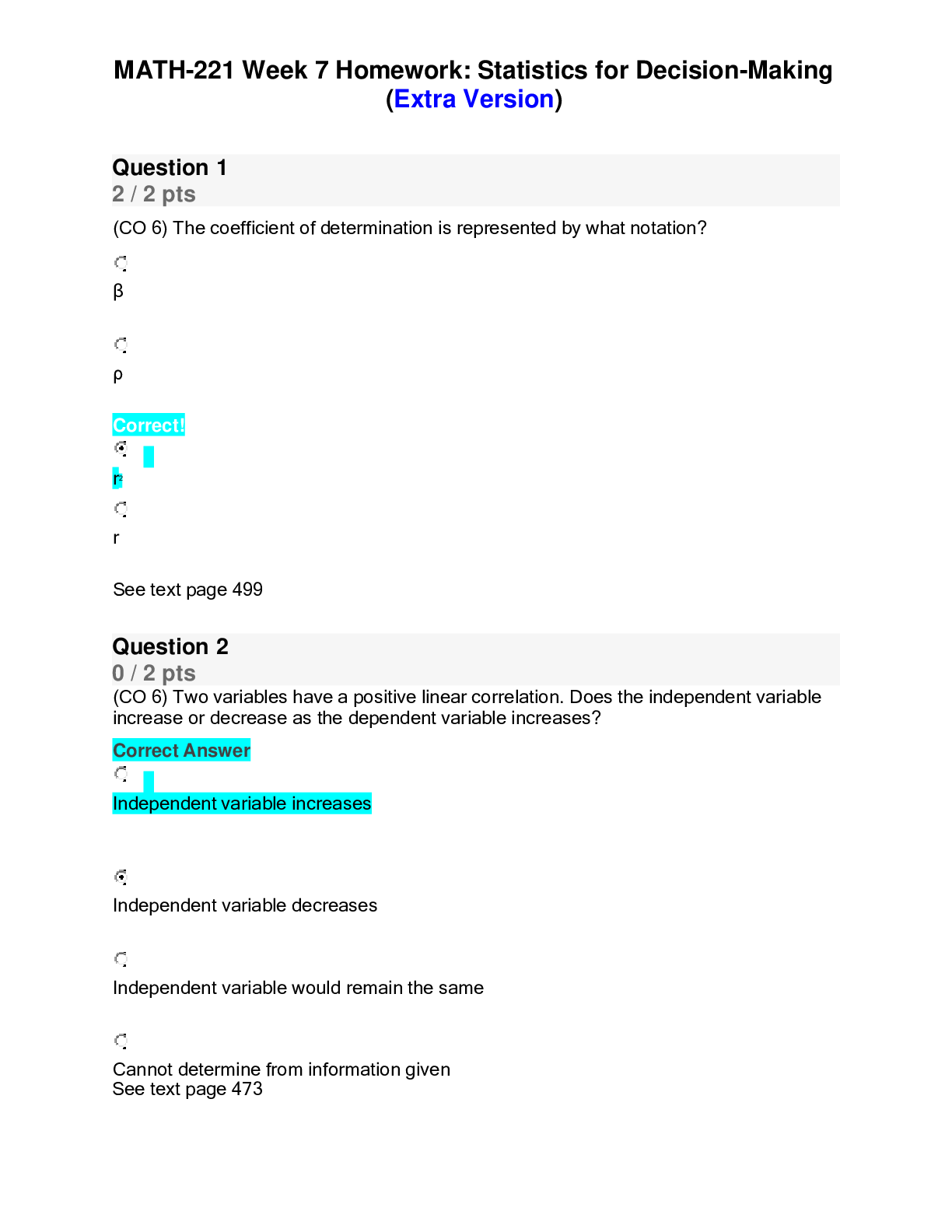

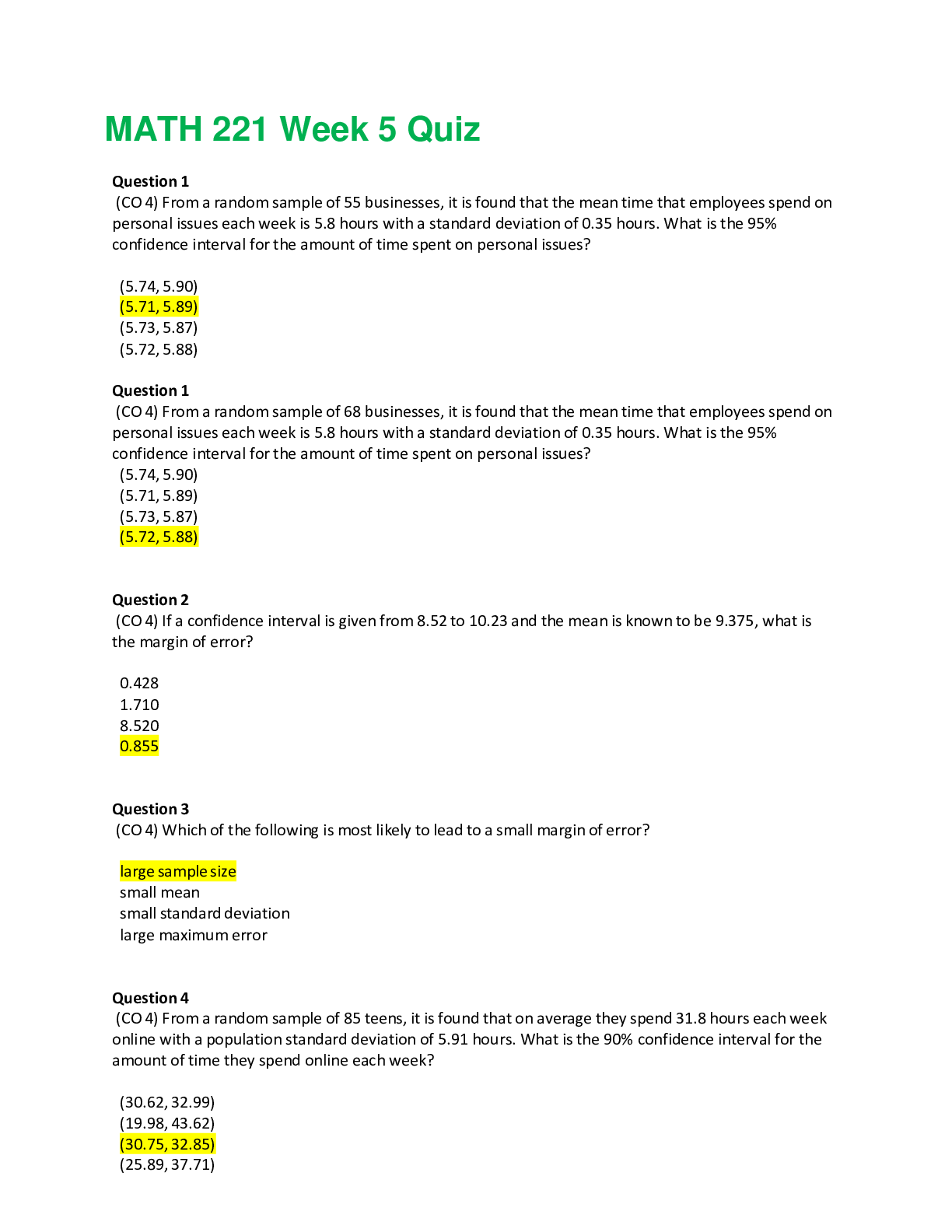

HSM 340 Week 7 Quiz These are the automatically computed results of your exam. Grades for essay questions, and comments from your instructor, are in the "Details" section below. Question Type... : # Of Questions: # Correct: Multiple Choice 4 3 Short 2 N/A Essay 1 N/A Question 1. Question : (TCO 7) A High Deductible Health Plan with a Savings Option does not include the following? Student Answer: First dollar payment for health services A bank administered medical savings account. Links to traditional health plans such as HMOs and PPOs High deductibles Instructor Chapter 7 Explanation: Points Received: 0 of 5 Comments: Chapter 7 Question 2. Question : (TCO 7) A withhold is a feature for payment to health care provider that: Student Answer: provides a mechanism for reducing risk to the payer. restricts covered services to beneficiaries. is used most frequently in indemnity health plans. none of the above. Instructor Chapter 7 Explanation: Points Received: 5 of 5 Comments: Question 3. Question : (TCO 7) The James Clinic is an organization of 100 physicians in a variety of specialties. They recently contracted with Prudential Health Plan on a capitated basis to provide all medical services to Prudential's members for the next three years. This HMO model would be defined as a: Student Answer: Staff Model Group Model Individual Practice Association Model Network Model Instructor Chapter 7 Explanation: Points Received: 5 of 5 Comments: Question 4. Question : (TCO 7) Suppose that AT&T had made an offer to acquire Merck Pharmaceuticals. Ignoring potential antitrust problems, this merger would be classified as a: Student Answer: Cross-border merger Horizontal merger Conglomerate merger Vertical merger Instructor Chapter 20 Explanation: Points Received: 5 of 5 Comments: Question 5. Question : (TCO 7) A nursing home contracts with an HMO for skilled nursing care at $2.00 PMPM. If costs are expected to average $120 per day, what is the maximum utilization of days per 1,000 members that the nursing home can experience before it begins to lose money? Student Answer: Using the formula PMPM cost = (expected encounters per year x cost per encounter)/12 Equation: 2.00 = (X times 120)/12=0.2 This answer equals 0.2, but multiply that by 1,000 members and the final result is 200 days. Maximum annual use per 1,000 Members = [$2.00 × 1,000 × 12] ÷ $120 = 200 Instructor Maximum annual use per 1,000 Members = [$2.00 × 1,000 × 12] ÷ $120 = Explanation: 200 chapter 7 Points Received: 10 of 10 Comments: Question 6. Question : (TCO 7) An uninsured patient receives services with charges of $5,000 from a hospital. The hospital staff bills the patient $1,000 and records $4,000 as charity care. If the hospital's ratio of cost to charges is 50%, what amount would the hospital recognize as charity care in Schedule H of IRS Form 990? Student Answer: $4000*.50=$2000 If the 50% of the $4000 which is $2000 is not billed to the patient, then that hospital recognizes the rest as charity care the other 50% will go to the Schedule H of IRS Form 990. Instructor --$2,000 (50% X $4,000) Chapter 5 Explanation: Points Received: 10 of 10 Comments: Question 7. Question : (TCO 7) How is charity care usually defined? Student Answer: Charity care is provided free of cost to individuals who can't afford the services that are needed to give care to them. This can also be referred to as indigent care and organizations have to determine which care is to be considered charity care rather than debt. Some organizations do receive some incentives from the government when they provide charity care for individuals. Instructor Charity care is usually defined as the unreimbursed cost of providing the Explanation: care. To be recognized as charity care, the health care provider must not have billed the patient for the portion that is being recognized as charity care. In addition, any revenues realized must be offset against the cost of providing the charity care. Chapter 5 Points Received: 10 of 10 Comments: * Times are displayed in (GMT-07:00) Mountain Time (US & Canada) [Show More]

Last updated: 1 year ago

Preview 1 out of 4 pages

.png)

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Oct 06, 2022

Number of pages

4

Written in

Additional information

This document has been written for:

Uploaded

Oct 06, 2022

Downloads

0

Views

55

(1).png)