FIN 320 SOPHIA Principles of Finance Unit 3 Challenge 1. All Correct Answers

Document Content and Description Below

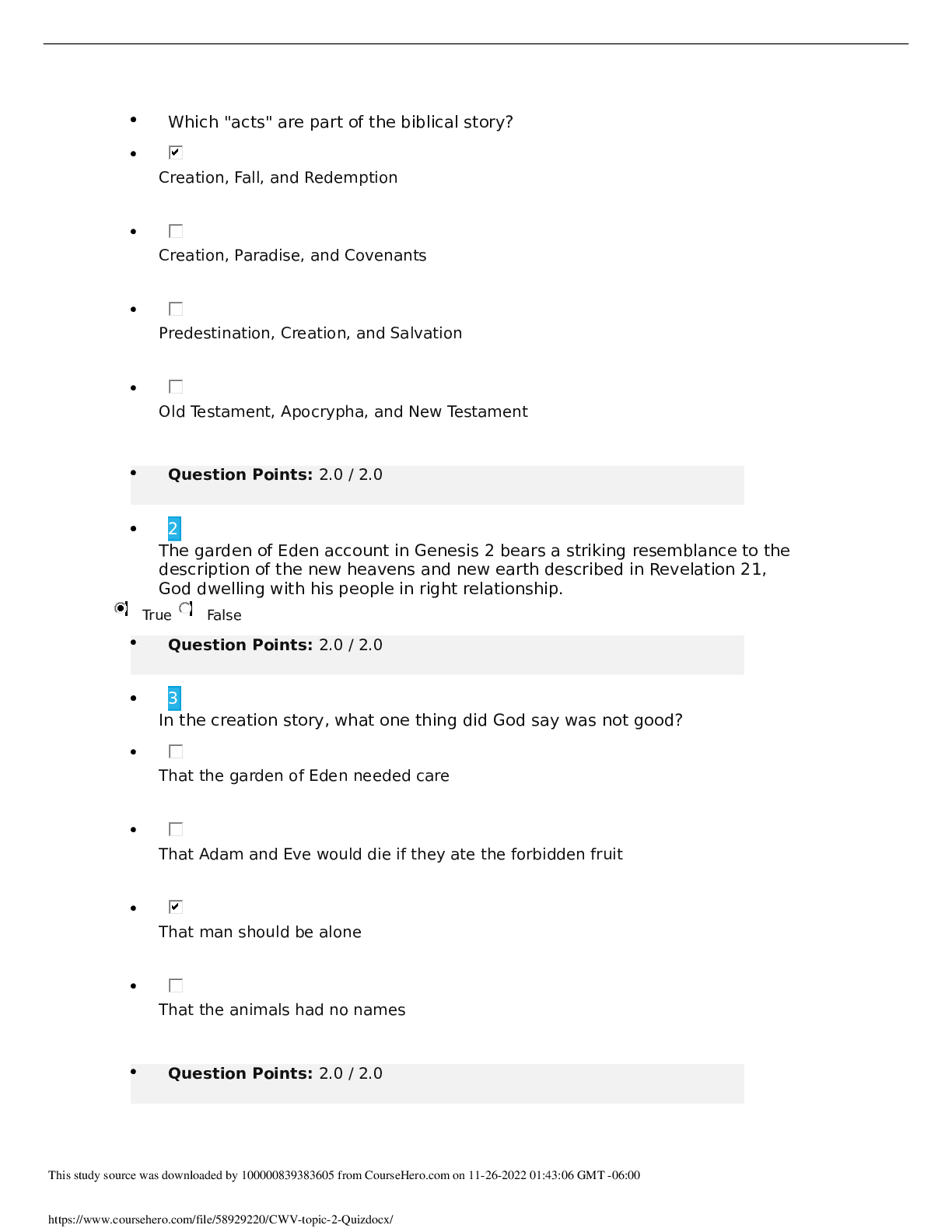

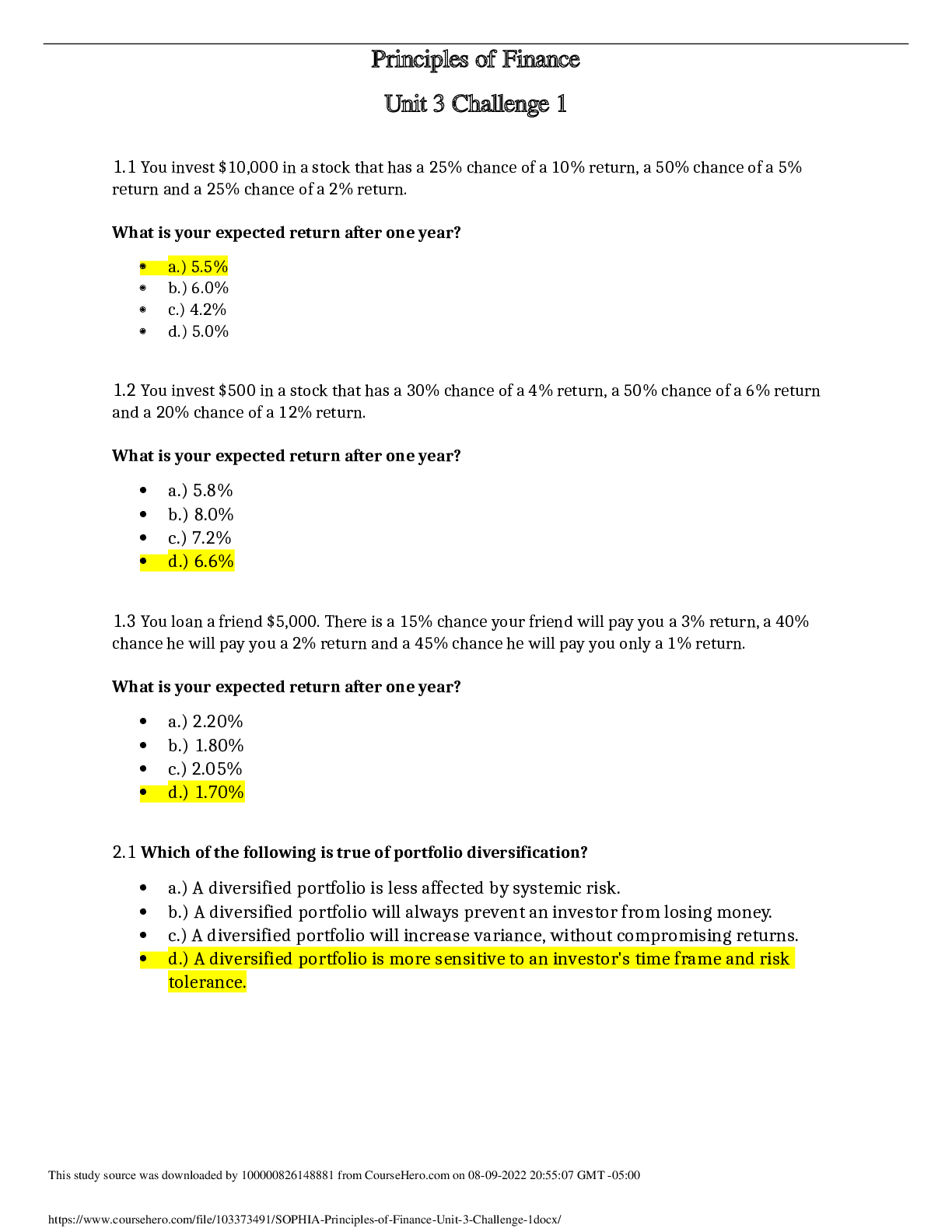

Principles of Finance Unit 3 Challenge 1 1.1 You invest $10,000 in a stock that has a 25% chance of a 10% return, a 50% chance of a 5% return and a 25% chance of a 2% return. What is your expected... return after one year? • a.) 5.5% • b.) 6.0% • c.) 4.2% • d.) 5.0% 1.2 You invest $500 in a stock that has a 30% chance of a 4% return, a 50% chance of a 6% return and a 20% chance of a 12% return. What is your expected return after one year? • a.) 5.8% • b.) 8.0% • c.) 7.2% • d.) 6.6% 1.3 You loan a friend $5,000. There is a 15% chance your friend will pay you a 3% return, a 40% chance he will pay you a 2% return and a 45% chance he will pay you only a 1% return. What is your expected return after one year? • a.) 2.20% • b.) 1.80% • c.) 2.05% • d.) 1.70% 2.1 Which of the following is true of portfolio diversification? • a.) A diversified portfolio is less affected by systemic risk. • b.) A diversified portfolio will always prevent an investor from losing money. • c.) A diversified portfolio will increase variance, without compromising returns. • d.) A diversified portfolio is more sensitive to an investor's time frame and risk tolerance. 2.2 Why is it a good idea to diversify an investment portfolio? • a.) To maximize potential returns. • b.) To reduce specific risk. • c.) To reduce systemic risk. • d.) To eliminate variance. 2.3 Which of the following is true of portfolio diversification? • a.) Diversification can eliminate or reduce specific risk or systemic risk, depending on asset class. • b.) Diversification can reduce or eliminate both specific risk and systemic risk. • c.) Diversification can reduce or eliminate specific risk, but not systemic risk. • d.) Diversification can reduce or eliminate systemic risk, but not specific risk. 3.1 Surprise news or announcements may affect the day to day variance of a stock's price, also known as its __________. • a.) fundamental analysis • b.) beta • c.) credit-worthiness • d.) market share 3.2 What is the effect of a merger or acquisition announcement on the stock price of a company involved in the restructuring? • a.) M&A announcements typically have little effect on the stock price of the companies involved. • b.) It will likely decrease because M&A announcements are a signal of market instability. • c.) It could increase or decrease, depending on how analysts interpret the long term outlook of the company. • d.) It will likely increase because analysts add together the stock prices of the companies involved. 3.3 Which of the following credit ratings would make a country or company have the most difficult time raising capital? • a.) B • b.) BBB • c.) A • d.) AA 4.1 The risk that the person to whom you lent money will not be able to pay you back is known as __________. • a.) credit risk • b.) liquidity risk • c.) model risk • d.) market risk 4.2 The risk that you will not be able to immediately convert a non-cash asset into cash when you need it is known as __________. • a.) asset-backed risk • b.) default risk • c.) liquidity risk • d.) operational risk 4.3 The risk that your investment in a stock will lose value because of a general economic decline is known as __________. • a.) market risk • b.) foreign investment risk • c.) model risk • d.) interest rate risk 5.1 A beta coefficient is best understood as __________. • a.) a measure of the degree of risk associated with an individual investment • b.) a measure of the probability that a portfolio will meet its expected return in a given period • c.) a measure of the degree of correlation between the performance of two stocks • d.) a measure of the volatility of a portfolio as compared to a benchmark 5.2 If a portfolio regularly rises when a benchmark index rises, but it rises less than the benchmark does, the portfolio's beta coefficient could be __________. • a.) 1.0% • b.) -1.0% • c.) -0.5% • d.) 0.5% 5.3 Covariance is best understood as __________. • a.) the sum of the risk premiums of two investments • b.) the quantity by which an investment outcome deviates from its expected mean • c.) the degree to which two investments' values change together • d.) the extent to which the value of a portfolio changes in relation to a benchmark index 6.1 Which of the following is true of systematic risk? • a.) It is also known as non-diversifiable risk. • b.) Diversification holds less of a benefit for this type of risk when the number of assets within a portfolio exceeds 30. • c.) It can be minimized when investment correlations are at zero. • d.) It is uncorrelated with broader market returns. 6.2 Which of the following is true of unsystematic risk? • a.) It is also known as diversifiable risk. • b.) It is the portion of risk that assumes the risk premium. • c.) It can be mitigated with active fund management, but not passive fund management. • d.) It is unaffected by hedging. 6.3 Which of the following is true of unsystematic risk? • a.) It is more tightly linked to the market as a whole than systematic risk. • b.) It is unaffected by the level of diversification within a portfolio. • c.) It is also known as non-diversifiable risk. • d.) It can be minimized when investment correlations are at zero or even slightly positive. 7.1 A security that is plotted low on the X-axis of the security market line graph has __________. • a.) a small expected return • b.) a large expected return • c.) a small beta value • d.) a large beta value 7.2 A security that falls below the security market line is __________. • a.) attractive for an investor • b.) unattractive for a company raising capital • c.) under-valued for its level of risk • d.) over-valued for its level of risk 7.3 A security that is plotted to the far right on the Y-axis of the security market line graph has __________. • a.) a large expected return • b.) a large beta value • c.) a small beta value • d.) a small expected return [Show More]

Last updated: 1 year ago

Preview 1 out of 4 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 10, 2022

Number of pages

4

Written in

Additional information

This document has been written for:

Uploaded

Aug 10, 2022

Downloads

0

Views

48