NACVA FINAL Exam with complete solutions

Document Content and Description Below

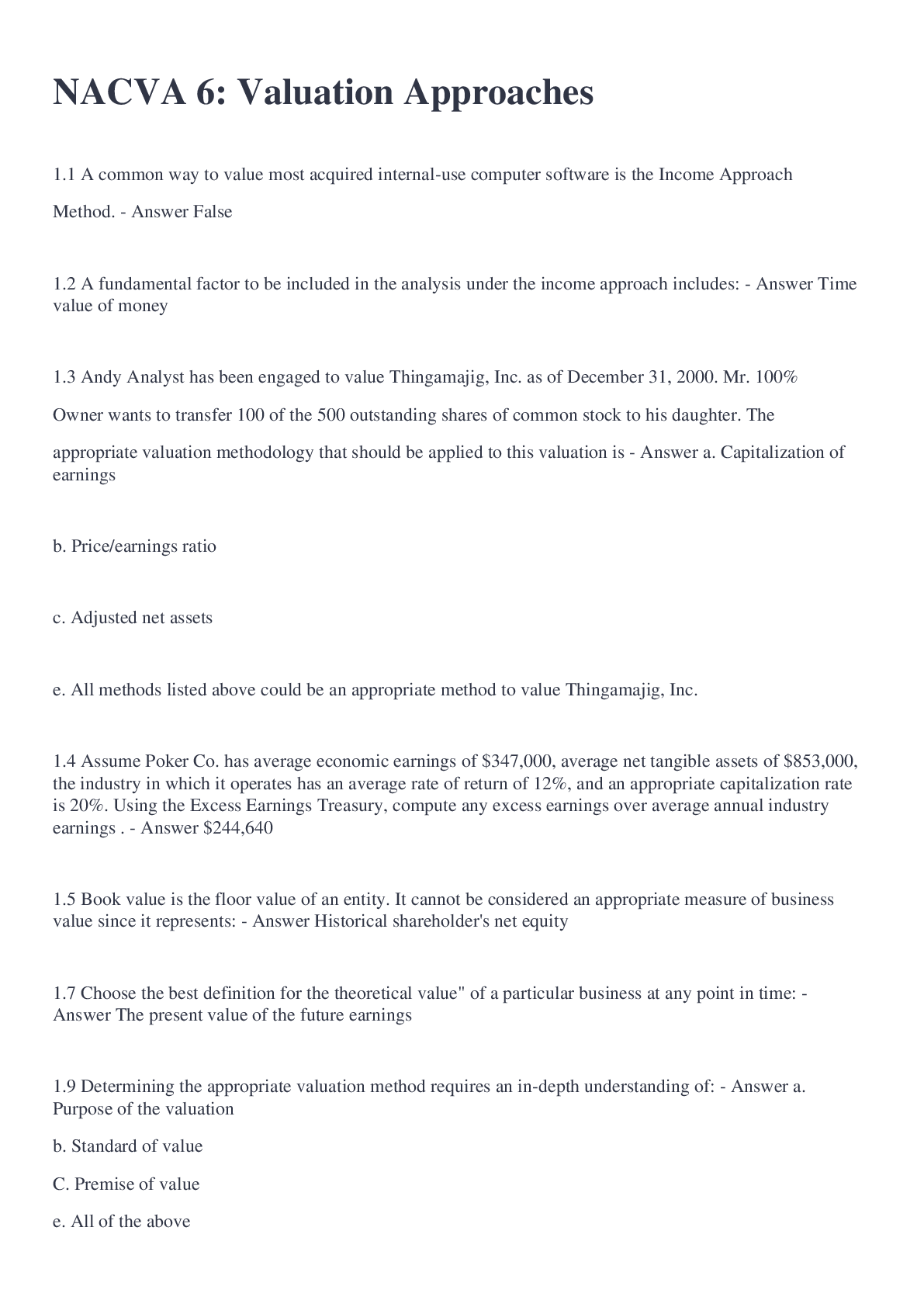

1.1 A common way to value most acquired internal-use computer software is the Income Approach Method. False 1.2 A fundamental factor to be included in the analysis under the income approach inc... ludes: Time value of money 00:06 01:26 1.3 Andy Analyst has been engaged to value Thingamajig, Inc. as of December 31, 2000. Mr. 100% Owner wants to transfer 100 of the 500 outstanding shares of common stock to his daughter. The appropriate valuation methodology that should be applied to this valuation is a. Capitalization of earnings b. Price/earnings ratio c. Adjusted net assets e. All methods listed above could be an appropriate method to value Thingamajig, Inc. 1.4 Assume Poker Co. has average economic earnings of $347,000, average net tangible assets of $853,000, the industry in which it operates has an average rate of return of 12%, and an appropriate capitalization rate is 20%. Using the Excess Earnings Treasury, compute any excess earnings over average annual industry earnings . $244,640 1.5 Book value is the floor value of an entity. It cannot be considered an appropriate measure of business value since it represents: Historical shareholder's net equity 1.7 Choose the best definition for the theoretical value" of a particular business at any point in time: The present value of the future earnings 1.9 Determining the appropriate valuation method requires an in-depth understanding of: a. Purpose of the valuation b. Standard of value C. Premise of value e. All of the above 1.10 For valuing a medium-sized manufacturing concern, or an interest therein, which of the following would commonly be considered the LEAST reliable market valuation method? Industry Rules of Thumb 1.11 If an analyst determines that the earnings stream of a company is the most appropriate estimate of future benefits, in general, which earnings stream do analysts believe is the most reliable and stable? Net income before tax, depreciation, and amortization 1.12 If the cash flows of a business were the exact same over a trailing five-year period, which of the following income based valuation approaches would be the most appropriate? Capitalization of five-year average earnings using inflationary growth 1.13 In order to value an intangible asset, the analyst should focus on: Earnings capacity 1.14 Multi-period earnings method, binomial modeling, and option-pricing models are all examples of which approach to Fair Value under FASB's ASC 820? Income approach [Show More]

Last updated: 1 year ago

Preview 1 out of 33 pages

Also available in bundle (1)

NACVA EXAMS BUNDLED WITH COMPLETE SOLUTIONS

NACVA FINAL Exam with complete solutions/NACVA FINAL Exam with complete solutions

By EVALEEN 1 year ago

$18.5

2

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 07, 2022

Number of pages

33

Written in

Additional information

This document has been written for:

Uploaded

Aug 07, 2022

Downloads

0

Views

61