FIN 534 Week 6 Questions And Answers( Complete Solution)

Document Content and Description Below

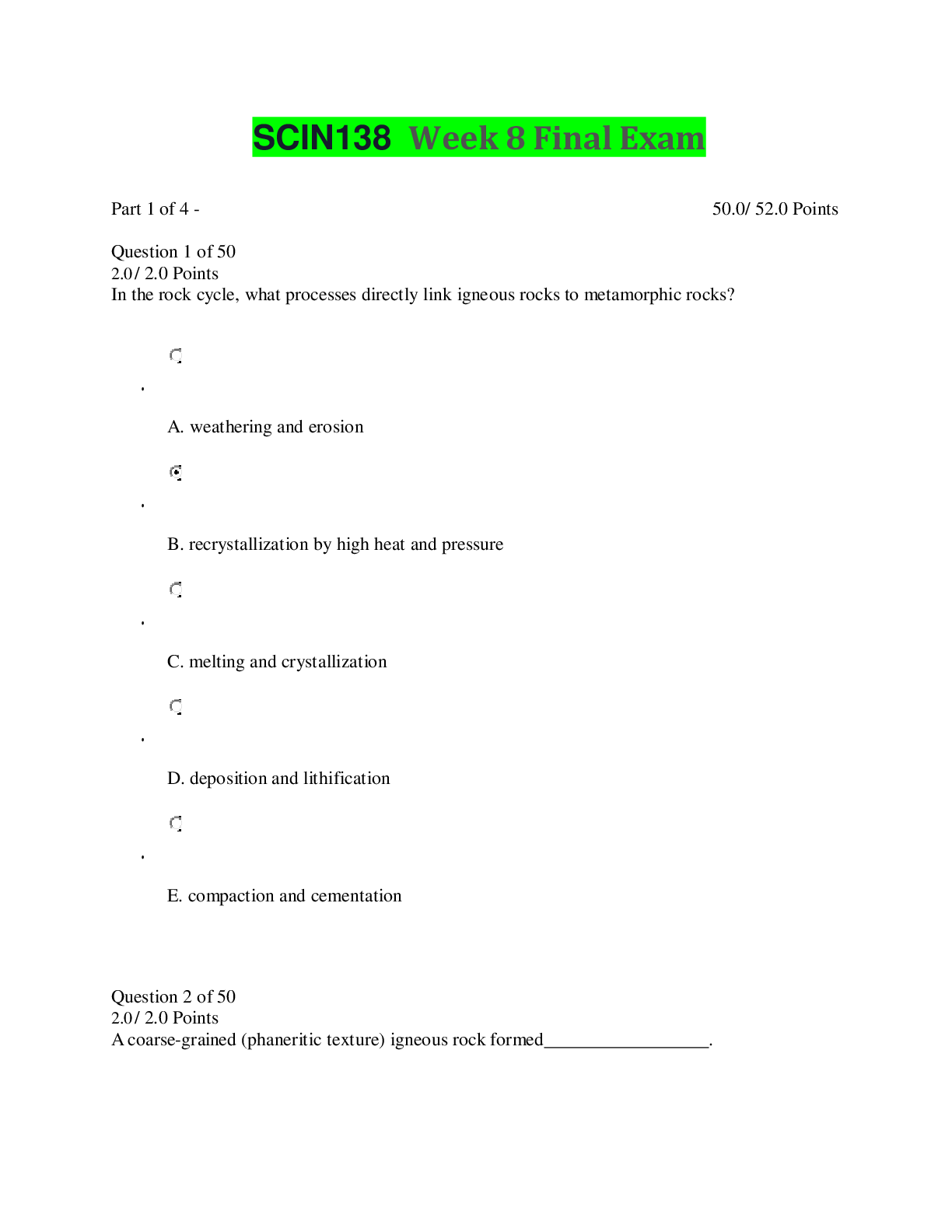

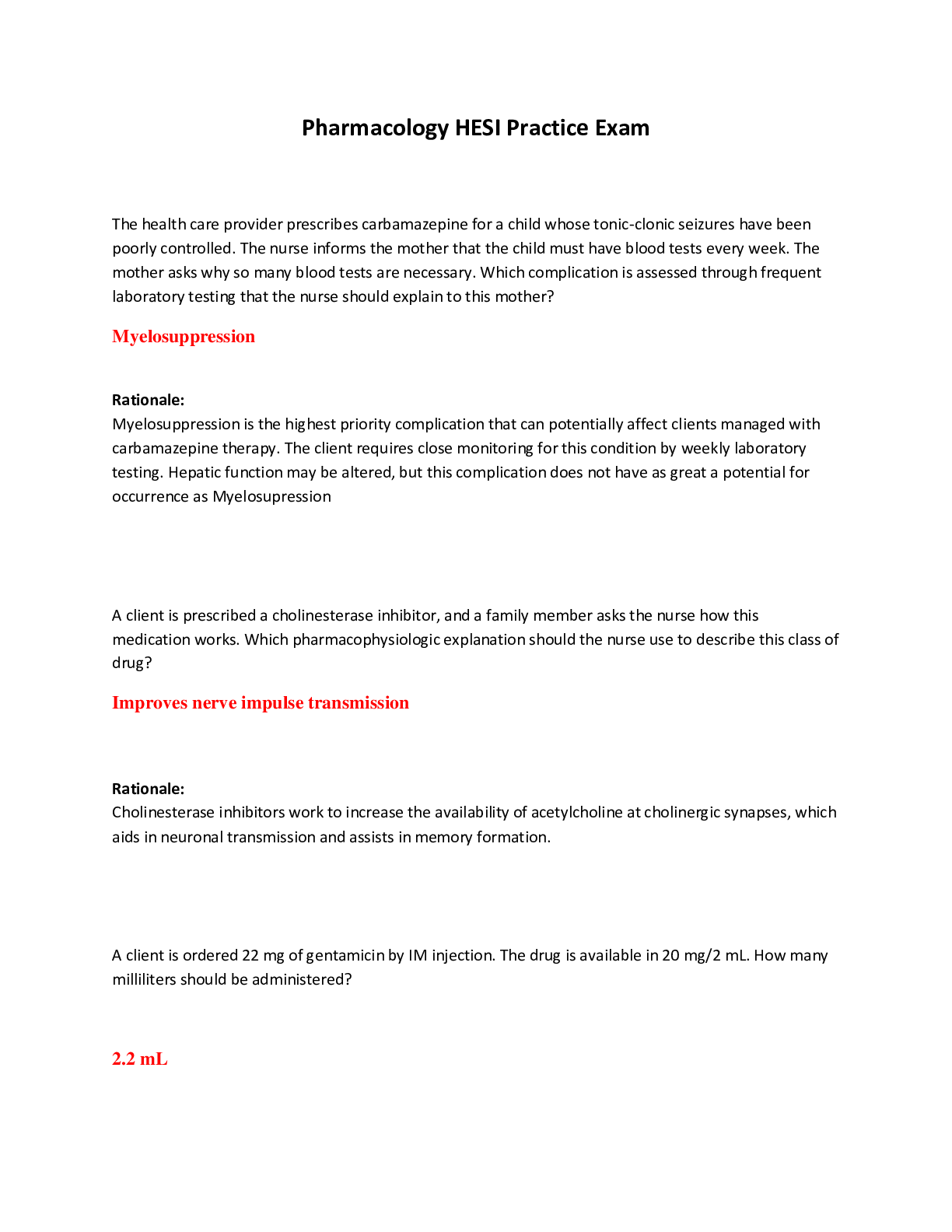

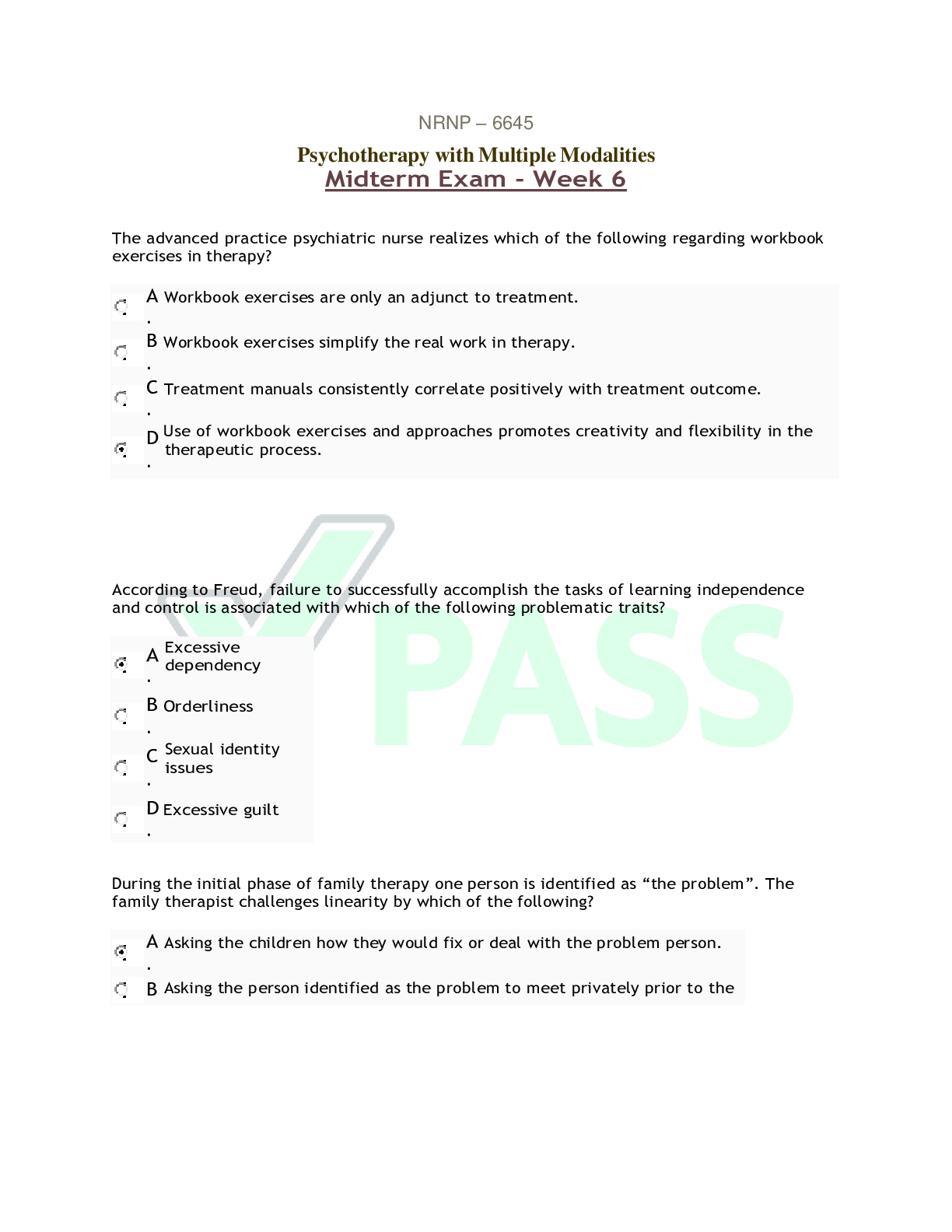

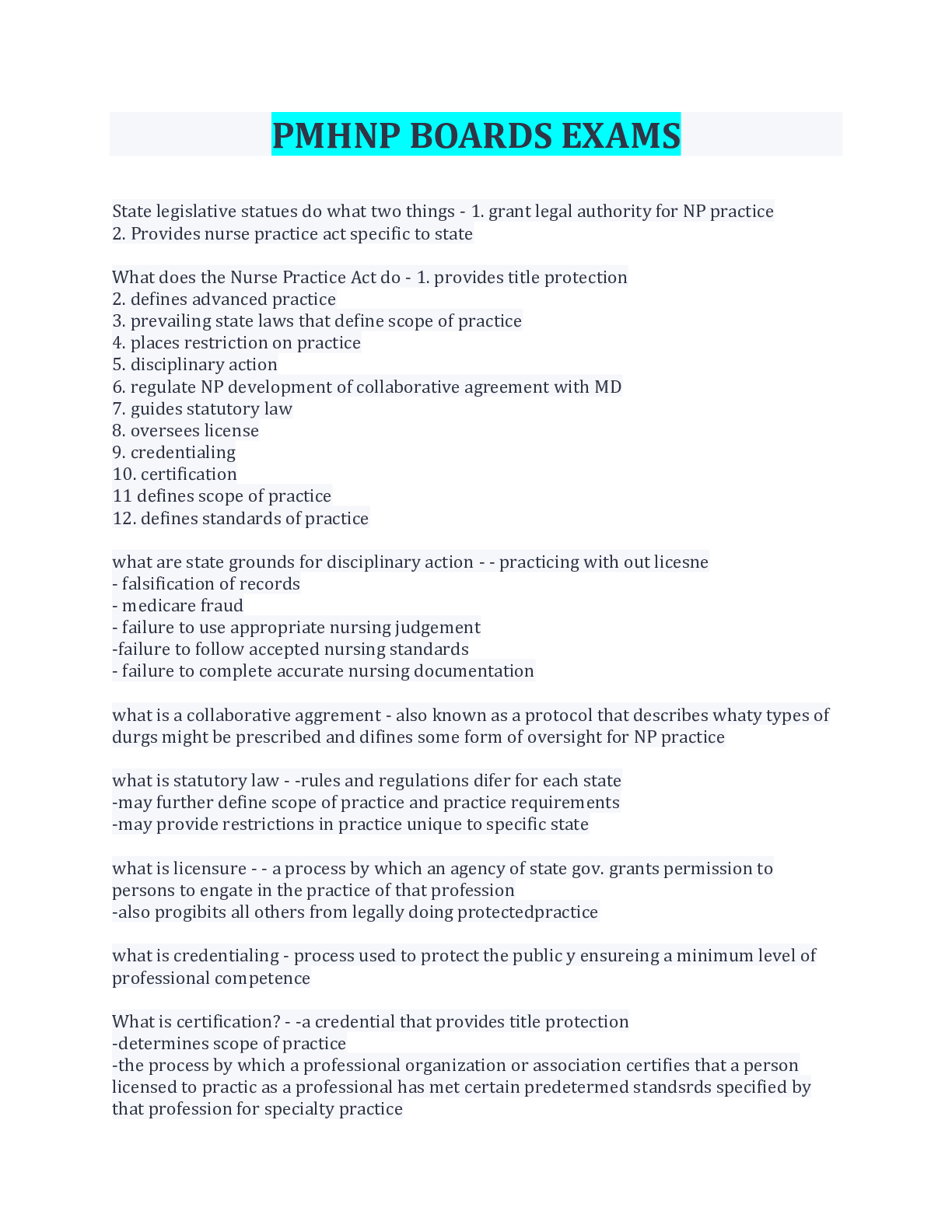

• Question 1 4 out of 4 points An investor who writes standard call options against stock held in his or her portfolio is said to be selling what type of options? Answer Selected Answer: Covered Cor... rect Answer: Covered • Question 2 4 out of 4 points Which of the following statements is most correct, holding other things constant, for XYZ Corporation's traded call options? Answer Selected Answer: The price of these call options is likely to rise if XYZ's stock price rises. Correct Answer: The price of these call options is likely to rise if XYZ's stock price rises. • Question 3 4 out of 4 points An option that gives the holder the right to sell a stock at a specified price at some future time is Answer Selected Answer: a put option. Correct Answer: a put option. • Question 4 4 out of 4 points Cazden Motors' stock is trading at $30 a share. Call options on the company's stock are also available, some with a strike price of $25 and some with a strike price of $35. Both options expire in three months. Which of the following best describes the value of these options? Answer Selected Answer: If Cazden's stock price rose by $5, the exercise value of the options with the $25 strike price would also increase by $5. Correct Answer: If Cazden's stock price rose by $5, the exercise value of the options with the $25 strike price would also increase by $5. • Question 5 4 out of 4 points The current price of a stock is $50, the annual risk-free rate is 6%, and a 1-year call option with a strike price of $55 sells for $7.20. What is the value of a put option, assuming the same strike price and expiration date as for the call option? Answer Selected Answer: $9.00 Correct Answer: $9.00 • Question 6 4 out of 4 points Braddock Construction Co.'s stock is trading at $20 a share. Call options that expire in three months with a strike price of $20 sell for $1.50. Which of the following will occur if the stock price increases 10%, to $22 a share? Answer Selected Answer: The price of the call option will increase by less than $2, but the percentage increase in price will be more than 10%. Correct Answer: The price of the call option will increase by less than $2, but the percentage increase in price will be more than 10%. • [Show More]

Last updated: 1 year ago

Preview 1 out of 14 pages

Instant download

Instant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jun 28, 2022

Number of pages

14

Written in

Additional information

This document has been written for:

Uploaded

Jun 28, 2022

Downloads

0

Views

57

.png)

.png)

.png)

.png)

.png)