Microeconomics > QUESTIONS & ANSWERS > Sophia Macro Unit 3 Challenge 2 Latest Updated 2022 Rated A (All)

Sophia Macro Unit 3 Challenge 2 Latest Updated 2022 Rated A

Document Content and Description Below

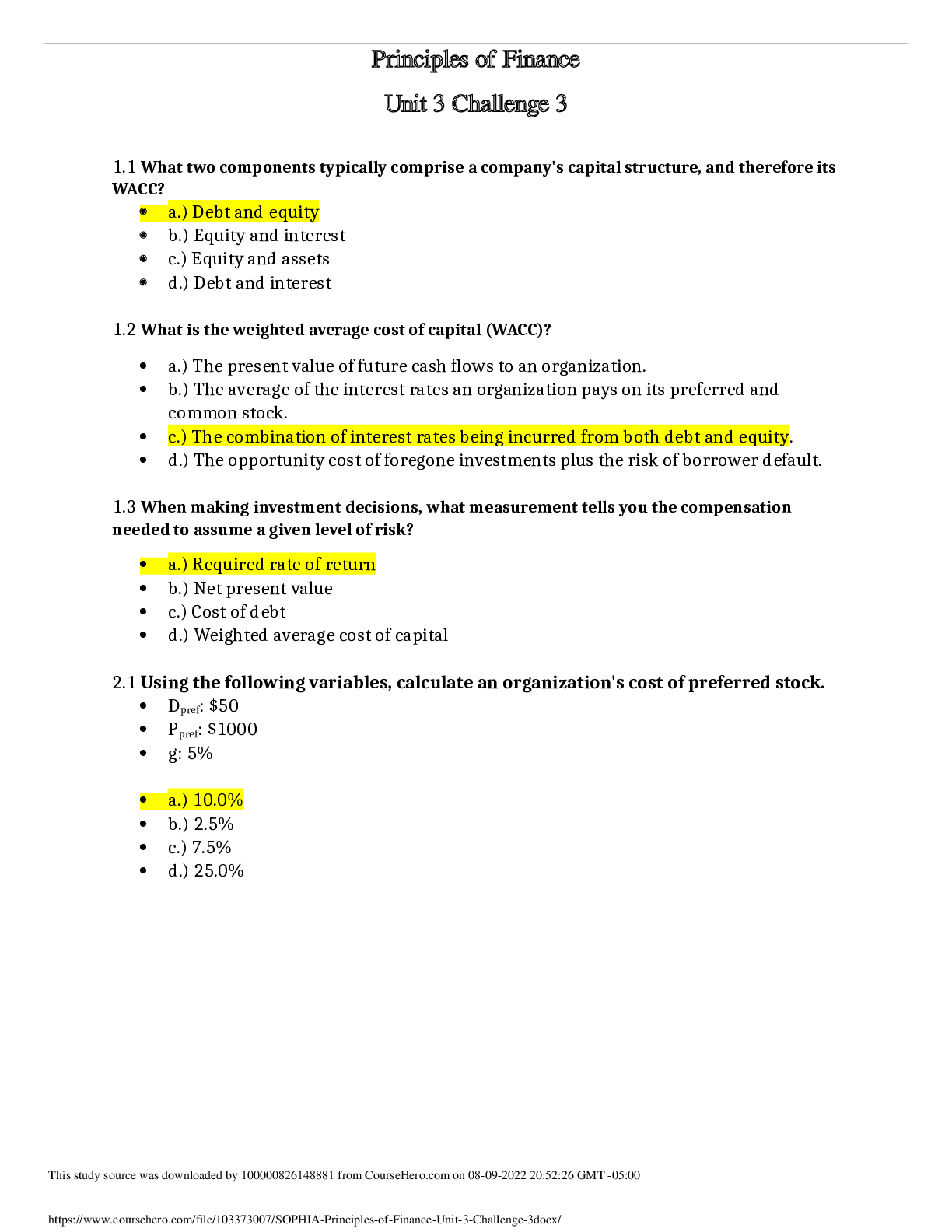

Which of the following statements regarding different types of money is true? b.) Time deposits belong in the least liquid category of money. Select the answer below that has the three examples of ... money in order from most liquid to least liquid. b.) Dollar bills, checking account balances, money market mutual funds The M1 definition of money includes __________. a.) physical currency and demand deposits If the reserve requirement of a bank is 20%, then the multiplier effect will be ________ and $50 in M1 will increase the money supply by ________. d.) 5; $250 If the reserve requirement of a bank is 25%, then the multiplier effect will be ________ and $200 in M1 will increase the money supply by ________. a.) 4; $800 If the reserve requirement of a bank is 50%, then the multiplier effect will be ________ and $100 in M1 will increase the money supply by ________. c.) 2; $200 What is the result when the Federal Reserve buys Treasury bonds? b.) More currency in the hands of the public This study source was downloaded by 100000831988016 from CourseHero.com on 06-22-2022 15:47:45 GMT -05:00 https://www.coursehero.com/file/76353076/Macro-Unit-3-Challange-2docx/ Which statement is NOT true regarding the way that the Federal Reserve controls the money supply? a.) The U.S. Treasury sends the money it prints directly into circulation. When the Fed sells bonds, the result is an increase in __________. b.) interest rates Which of the following statements is true as it relates to banks and the federal funds market? b.) Banks with less than the reserve requirement need overnight loans to meet their obligations. Fed member banks enter the federal funds market in order to __________. c.) meet reserve requirements The federal funds rate is paid to __________. c.) banks who lend excess reserves to other member banks Which statement below is true about the discount rate? a.) It is the rate that the Fed charges member banks for short term loans. Why would banks need to borrow directly from the Fed? c.) To meet the reserve requirement This study source was downloaded by 100000831988016 from CourseHero.com on 06-22-2022 15:47:45 GMT -05:00 https://www.coursehero.com/file/76353076/Macro-Unit-3-Challange-2docx/ Which statement below is true about the discount rate? a.) This is the rate used when banks borrow directly from the Fed. Which of the following statements regarding inflation is true? b.) When inflation is extreme, it can destroy a country's currency. Which of the following statements regarding goals of monetary policy is FALSE? c.) The Fed might seek to reduce inflation by increasing the money supply. Which of the following statements is associated with deflation? [Show More]

Last updated: 1 year ago

Preview 1 out of 3 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jun 22, 2022

Number of pages

3

Written in

Additional information

This document has been written for:

Uploaded

Jun 22, 2022

Downloads

0

Views

113

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)