BUSI 320 Connect Homework 6 Liberty University Complete Answer 2021

Document Content and Description Below

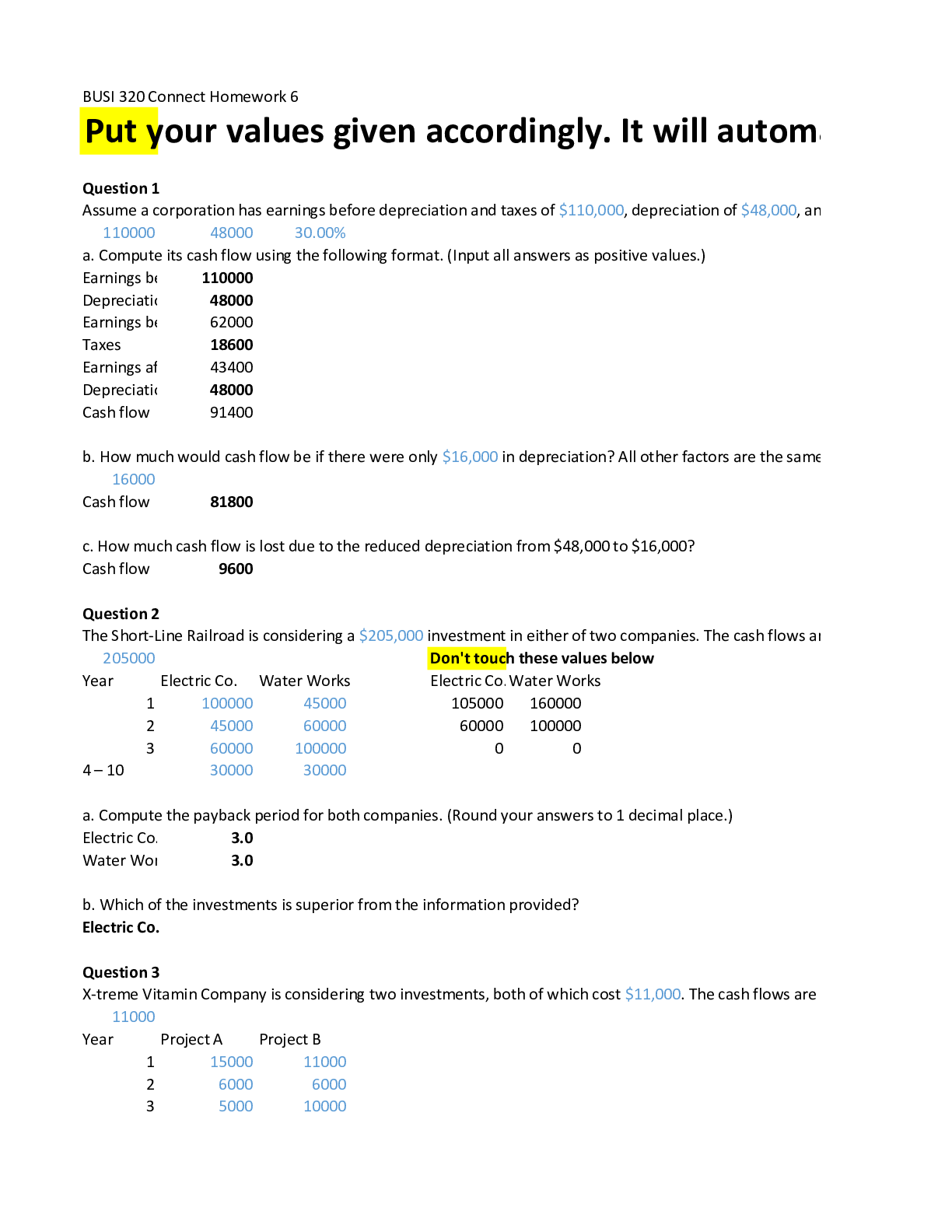

The below shown questions is just one version sample. Download the document for the complete solutions. Just put your values in the excel document to get your answers. Question 1 Assume a... corporation has earnings before depreciation and taxes of $110,000, depreciation of $48,000, and that it has a 30 percent tax bracket. a. Compute its cash flow using the following format. (Input all answers as positive values.) b. How much would cash flow be if there were only $16,000 in depreciation? All other factors are the same. c. How much cash flow is lost due to the reduced depreciation from $48,000 to $16,000? Question 2 The Short-Line Railroad is considering a $205,000 investment in either of two companies. The cash flows are as follows: a. Compute the payback period for both companies. (Round your answers to 1 decimal place.) b. Which of the investments is superior from the information provided? Question 3 X-treme Vitamin Company is considering two investments, both of which cost $11,000. The cash flows are as follows: Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. a-1. Calculate the payback period for Project A and Project B. (Round your answers to 2 decimal places.) a-2. Which of the two projects should be chosen based on the payback method? b-1. Calculate the net present value for Project A and Project B. Assume a cost of capital of 8 percent. (Do not round intermediate calculations and round your final answers to 2 decimal places.) b-2. Which of the two projects should be chosen based on the net present value method? c. Should a firm normally have more confidence in the payback method or the net present value method? Question 4 You buy a new piece of equipment for $28,808, and you receive a cash inflow of $3,700 per year for 14 years. Use Appendix D for an approximate answer but calculate your final answer using the financial calculator method. What is the internal rate of return? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Question 5 Home Security Systems is analyzing the purchase of manufacturing equipment that will cost $52,000. The annual cash inflows for the next three years will be: Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the financial calculator method. a. Determine the internal rate of return. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) b. With a cost of capital of 14 percent, should the equipment be purchased? Question 6 The Pan American Bottling Co. is considering the purchase of a new machine that would increase the speed of bottling and save money. The net cost of this machine is $51,000. The annual cash flows have the following projections. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. If the cost of capital is 12 percent, what is the net present value of selecting a new machine? (Do not round intermediate calculations and round your final answer to 2 decimal places.) b. What is the internal rate of return? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. Should the project be accepted? [Show More]

Last updated: 1 year ago

Preview 1 out of 77 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Sep 27, 2021

Number of pages

77

Written in

Additional information

This document has been written for:

Uploaded

Sep 27, 2021

Downloads

0

Views

48

Complete solutions.png)

NURS 3247Pharmacology - Proctored Assessment,.png)

.png)